The domain name incomeprotection.com.au is for sale.

Please contact shane@traderisk.com.au if you’re interested.

Protecting your income is vital for any tradie, especially if you’re self-employed.

At Trade Risk we can assist with personal accident insurance, including optional coverage for sickness.

To request a quote on personal accident insurance please click the button below.

Up until September 2019 we provided income protection insurance via our in-house financial adviser.

We no longer provide this service, and instead offer personal accident and sickness insurance. If you would specifically like a quote on income protection, we are able to refer you to one of our partners.

As we no longer provide advice on income protection insurance, the information below is provided for reference only and has not been updated since 2019.

Income protection is a vital form of insurance for tradespeople.

Via our referral partner, we have access to all the leading providers of income protection for tradies and can get you covered quickly with minimal paperwork.

Importantly, they can provide proper income protection insurance – not just accident and illness cover.

Some people only take out income protection insurance because they need it to get onto the work site, whilst others take it out because of the protection it provides to them and their family.

Whatever your reasons for taking out income protection, here at Trade Risk we can help you.

Income protection will pay you a monthly benefit if you cannot work due to injury or illness for a period of time. There are various options which will have an impact on the cover and the cost, and we will look at those in more detail below.

How our process works

Unlike public liability and tool insurance for tradies, which we can typically setup for you within a few minutes, income protection is a more involved process.

As we are not licensed to deal in income protection, we’ll pass your details on to our referral partner.

There are occasions where they can rush through cover same-day, but generally the process from start to finish takes a couple of days.

Why does it take longer? Because they provide genuine income protection insurance. It is more involved, but it is far superior to more basic policies.

Here’s how the process works:

1. Provide your details

The first step is to complete our online quote form. This will give our referral partner the information needed to put together some quotes for you.

2. They’ll email your quotes

They’ll research the market and email the quotes to you. They’ll include a few different options in terms of waiting periods and benefit periods.

3. You accept a quote and select your options

If you’re happy with one of the options, your financial adviser will put together a Statement of Advice (SOA) for you. This document is required by law, and will outline the reasons behind our recommendations. We’ll also send you the applicable Product Disclosure Statement (PDS) which outlines more information about the policy.

4. Application time

Once you’re comfortable with the information in the SOA and PDS, your financial adviser will arrange a time to run through the application with you. Most of our clients choose to do this over the phone, but if you’re in Brisbane and would prefer to apply in person, they can come to you.

5. Approval

If your application is a straightforward, they may be able to provide instant cover as soon as the phone application has been completed. If not, they’ll need to wait a day or two for the insurance company to provide their acceptance.

6. You’re covered!

Enjoy the peace of mind knowing that you now have a quality income protection policy in place.

If it sounds like a lot of steps above, it’s actually not that complicated. All of our forms are completed online (and are mobile-friendly) and the application process all happens over the phone with minimal fuss.

What is Income Protection?

Income protection is a form of insurance which can replace up to 75% of your income whilst you are unable to work.

A good policy will cover a tradie not only for events that happen in connection with their work, but any event that leaves you unable to work due to injury or illness.

Your policy will be made up of three main factors which affect the coverage and the cost:

- Benefit Amount: The amount you are covered for each month.

- Benefit Period: The length of time benefits will continue to be paid for.

- Waiting Period: The length of time before monthly benefits will commence.

We’ll go into more detail on each of these factors later in this guide.

Income protection insurance is especially important for self-employed tradies, but in reality it can be of benefit to any worker, as workers compensation and sick leave won’t take care of you forever.

Some brokers may recommend a policy to you known as “accident and illness” insurance or similar. They might even call it income protection, but it’s certainly not the same thing.

Accident and illness insurance can be cheaper, but it is an inferior policy compared to genuine income protection. The reason many brokers don’t offer genuine income protection is simply because they can’t.

Only an qualified financial adviser can be licensed to deal in income protection, and here at Trade Risk we have our own in-house financial adviser for this very reason.

If you’re serious about protecting yourself and your family, stick with the genuine cover.

Why Do I Need Income Protection?

For many tradesmen income protection will be mandatory in order to enter the work site. This is mainly the case for self-employed tradies and subcontractors, whilst employees will generally be covered by their employer’s work cover or sick leave.

Ultimately, if you can’t work you can’t earn money. And if you can’t earn money, who is going to pay the bills and keep food on the plate for your family? This is how income protection can really help a tradesman and his family.

Income protection is important for all workers, however it is especially important for tradesmen as this graph shows:

This graph released by Macquarie Life in June 2009 shows that manual and trade workers make up the overwhelming majority of income protection insurance claims.

The graph is getting a little old now, but we believe the stats would still be very similar today.

It’s also worth noting that most of the claims referred to in the graph are related to musculoskeletal injuries. Just because you don’t get sick doesn’t mean that you don’t need to be protected.

People who are self-employed, particularly in the manual trade professions, should definitely consider income protection cover.

Claims

We occasionally hear people complain that insurance companies never pay out. It must be said, this comes from tradies who haven’t previously been with Trade Risk!

When we recommend an income protection policy to you, we don’t choose the insurance company based purely on price, and we certainly don’t choose it based on how much commission they pay us.

Whilst price is a factor of course, one of the main things we look at is our claims experience with each company. We don’t want to spend time fighting claims. We want to have our clients with insurance companies that we know do the right thing at claim time.

So far in 2018 our claims record is 100%. That is, for each client who has lodged a claim with us, they have received a successful pay out. That’s a record we’re very proud of.

Because we do things this way it means we are not recommending the absolute cheapest option to our clients every time, which sometimes means we lose business to others who are willing to offer the cheapest option. But we know that every client who does choose to go with us is going to have a good experience if and when they need to claim, and don’t say it won’t happen to you, because we know that it does happen to good tradies around Australia every day.

Income Protection Options

There are a range of different options when it comes to income protection, and the options you choose can have a major impact on the cost of the cover as well as your ability to make a claim on the policy.

The main options have been detailed below:

Waiting Period

The waiting period is the amount of time you must be unable to work for before your benefits will start. The typical waiting period for a tradesman is 30 days, which simply means you must be unable to work for 30 days before you will be eligible for any benefits.

A shorter waiting period will equate to a higher premium, whilst a longer waiting period will result it a reduced premium.

When looking at the waiting period you may also want to consider a popular option known as day 1 accident cover. Follow the link for more information.

Benefit Amount

This is the amount that you will receive each month once you go on claim. Generally the maximum you can cover yourself for is 75% of your pre-tax income, however you can cover yourself for less if you wish.

The cost of your income protection will be heavily impacted be the benefit amount that you choose, and a higher benefit amount will equal a higher insurance premium.

Benefit Period

The benefit period relates to the length of time you will continue to receive benefits for once you are on claim.

Benefit period options for income protection are generally 2 years, 5 years or age 65. By choosing an age 65 benefit period you will continue to receive monthly benefits until you turn 65.

A longer benefit period will result in a higher premium, and a shorter benefit period will bring a lower premium.

What is the Waiting Period?

The waiting period on an income protection policy is the period of time a tradesman (or any other worker) must be unable to work for before they are eligible for benefits from their policy.

If you had a policy with a 30 day waiting period, you would have to wait for 30 days before you were eligible to receive any benefits.

But that doesn’t mean that you will start receiving benefits after 30 days, as virtually all income protection policies pay their benefits monthly in arrears.

So although you are entitled to benefits (i.e. payments) after 30 days, you will not be paid for another month after that date.

Let’s take a look at the waiting period in action. For this example we are using a waiting period of 30 days and are assuming that you are still unable to work.

- Day 1 – Your first day away from work due to injury or illness

- Day 30 – The last day of your waiting period

- Day 61 – On this day you will receive your first monthly benefit covering days 31 to 60

- After this time you will continue to be paid each month until you are able to return to work

So even though you have a 30 day waiting period, you won’t actually receive any money until 61 days have passed.

There are ways to be paid sooner, and we will cover those later in this guide.

Waiting Periods Available

The waiting periods offered vary slightly from one insurer to the next, however the most commonly available options are as follows:

- 14 days

- 30 days

- 60 days

- 1 year

- 2 years

For many people 30 days is the typical waiting period chosen. People who need to be paid sooner may choose the 14 day option, whilst those looking to save money on premiums may go with the 60 day option.

The one and two year options are typically used in conjunction with a second income protection policy.

For example you may have an existing policy with a two year benefit period which you do not want to cancel, so a second policy is established with a two year waiting period to kick in after the first policy has run out.

We won’t go into detail on why you might want two separate policies, but there are plenty of cases where this may be an appropriate strategy.

Day 1 Accident Cover

A popular option for many tradies who take out income protection is “day 1 accident cover”. This option can be added to most income protection policies available in Australia.

Day 1 accident cover means that, in the event of an accident, you can be paid the benefits from your income protection policy from day 1. However, there are some big differences between the policies offered by the insurance companies.

With one of the cheaper policies currently available, even if you have the “day 1 accident cover” option you still have to be unable to work for 30 consecutive days before you will receive any benefits. The benefits will then be backdated to day 1.

Another popular policy available, which isn’t a great deal more expensive, only requires you to be unable to work for 3 consecutive days before they start paying benefits to you, which are backdated to day 1.

If you can’t work and you’re not receiving an income, the difference between a policy that pays after 3 days off work will make a huge difference when compared to a policy that requires 30 days of work.

Example: If you sustained a minor injury and were off work for 28 days, the second policy would pay your full benefits for that period, paid after just three days. The first policy wouldn’t pay you a cent.

When selecting an income protection policy, it pays to use the services of a qualified professional. As this shows, when two companies offer an option with the same name, it definitely doesn’t mean they are equal.

Specific Injury Benefit

How to receive instant benefits from your income protection

As a tradie, you should know that your chances of making a claim on your income protection are quite high. Reports have shown that people in the manual trades are far more likely to claim than any other group.

With most income protection policies, whenever you make a claim you must first get through the ‘waiting period’ before you will receive any payments. Generally you must be off work for 30 days, depending on the policy chosen.

Whilst it’s great to know that your payments are on the way, wouldn’t it be better to get your hands on that money straight away?

With Macquarie Life’s income protection you can!

Macquarie Life, who are one of our preferred insurers for tradies, offer a ‘Specific Injury Benefit’ which will pay an immediate benefit to you in the event of certain injuries. This is regardless of your waiting period. What’s more, this option is included in the policy at no extra cost!

Receive benefits without being away from work

The policy will pay you an immediate benefit regardless of whether or not the injury keeps you away from work. That means you could fracture your wrist, return to work the following week and still receive one month worth of benefits. You could return to work the next day and still receive the full benefit!

How much can you get?

The full details of which injuries are covered are detailed in the Product Disclosure Statement, but here are a few common examples:

- Fracture of the lower arm or wrist – 1 month’s benefits

- Fracture of the upper arm – 2 month’s benefits

- Fracture of the leg – 2 month’s benefits

- Fracture of the thigh or pelvis – 3 month’s benefits

- Total and permanent loss of the sight in one eye – 12 month’s benefits

- Paralysis – 5 year’s benefits

The injury does not need to occur at work, as the policy provides 24 hour protection. If you trip over and break your wrist whilst kicking the footy on the weekend, you’ll be covered.

Income Protection Cost

The cost of your income protection will depend heavily on the options you select for your cover.

As well as the options selected, your premium will also be impacted upon by your age, smoking status and occupation.

Your premium will generally increase as you get older, and will also be higher if you are a smoker. Higher risk trades will also generally attract higher premiums.

Tax Treatment

Whether you’re a self-employed tradesman, subcontractor or simply on wages, income protection insurance is virtually always 100% tax deductible.

The flip side is that any benefits paid from your policy must be declared as income on your tax return, and will therefore by subject to income tax. With that in mind you need to ensure that you benefit amount is sufficient to cover your living expenses as well as the tax bill.

Tradesman Income Protection

Income protection insurance is available for virtually all trades and associated occupations in Australia.

Whilst there are some tradesmen who will struggle to obtain the top level of cover, such as scaffolders and tradies on underground mine sites, most standard trades will have no problem in getting the same level of cover that would be available for any other white collar manager.

When taking out income protection for a tradie it is important to use a financial adviser or insurance broker who specialises trade insurance.

A specialist adviser will know which providers and which policies will provide the necessary cover to suit your personal needs as well as your trade.

To have a chat about your needs or to get a quote, please contact us or complete our quick and easy online quote request.

That will never happen to me

The following piece was written by Paul Simpson, a financial adviser who previously worked for Trade Risk.

Many times during my years as a Financial Planner specialising in Risk Insurance, I have heard healthy Tradesmen tell me that they don’t need to have Income Protection Insurance because they are fit and healthy and don’t get sick. They ‘sometimes catch a cold’ but nothing ever happens that would lead to the need to take extended time off work.

It is a common misconception that Income Protection insurance is only for people who regularly succumb to illness or are prone to injury and take a lot of time off work.

Having this insurance in place, can in many instances, mean the difference between a person being able to recover from their illness or injury with the peace of mind in knowing the bills will still be paid from the Income Protection Benefits, or quite literally watching their business go broke due to their inability to generate income and sometimes even to put food on the table – particularly for a self-employed tradesman.

I have recently had experience with 2 such Tradesmen that took out Income Protection insurance solely because it was a requirement for them to work on building sites. With both gentlemen, they were sole trader/Subcontractor Tradesmen and therefore, were not covered by Workcover or the relevant Workers insurance in their state.

Both were in very good health and during the process of implementing the policies, made no secret of the fact that if it was up to them, they would not take the policy out as they ‘don’t get sick’.

The first gentleman is a 32 year old carpenter named Scott who recently went from being an employee to a contractor and was therefore required to have Income Protection insurance to work on site. He told me that he never gets sick so can’t understand what the fuss is all about with Income Protection.

This gentleman’s policy went into force in early June 2018. You can imagine my surprise when he called me rather sheepishly, 3 weeks later to say that he had injured his forearm at work while building a deck. Nothing out of the ordinary for a Carpenter but as simple as putting his 95kg weight on his right arm while balancing on the deck and he tore the tendon. This was very painful and resulted in his inability to hold a hammer – a fairly integral part of being a carpenter.

Scott was very concerned as he was only in the initial stages of being a contractor and had done his financial calculations for his new business, based on continued work and without considering the potential effects of 8 weeks of no work that the Doctors he consulted over the injury, told him he needed to take.

Aside from the physical pain of the injury, this caused some distress in the home life because Scott and his wife had plans to buy a home in the short term and were saving money towards a deposit. Scott’s wife was obviously concerned about the injury but was also very concerned because the deposit saving plans seemed destined to be put on the shelf while she had to cover all expenses with her newly self-employed husband having an indefinite hiatus from work (and income) while his arm repaired.

Scott was initially reluctant to make a claim on his Income Protection insurance because it had been going for less than a month and he felt a claim was too soon. I reminded him that this is precisely why people have Income Protection insurance and urged him to proceed with the claim.

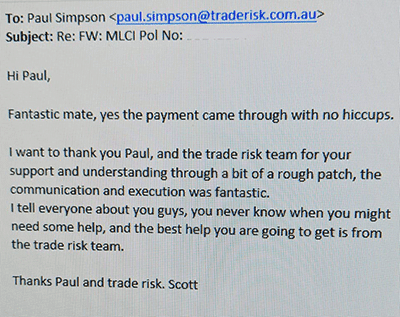

Scott agreed and I collected the necessary paperwork and contacted the insurer, MLC, to notify them of an impending claim. Their response and subsequent service both to me as the Adviser and to Scott as the client, was exceptional and demonstrated that they understood the difficult position that this unplanned injury had caused to Scott and his family. To sweeten this deal further; Scott’s policy had only been going for 3 weeks and he had paid the first monthly premium. Because he went on claim during that month and premiums are not payable while on claim; Scott had the first month’s premium refunded to him as well as the normal benefit amount.

The result? Scott received benefit payments from MLC which kept everything going while he recovered and now he is back at work and his plans, and those of his wife, were not interrupted by an unplanned injury. Oh, and Scott is now a believer in the importance of Income Protection Insurance.

The second example is very similar to the first; A fit and healthy Tradesman who had recently made the move from employee to contractor and couldn’t see the need for Income Protection. David is his name. David reluctantly took out his policy as a requirement to work on a construction site and genuinely believed that he would never have to make a claim.

Two months after implementing the policy, David fell backwards, climbing down from a ladder and landed on his elbow. The resulting jarring to his upper body, broke his collar bone and again, caused great pain and serious concern as it was immediately obvious to David that he needed significant time away from the tools and he had no leave entitlements.

David’s injury is more of a long- term problem than the first example and required multiple visits to an orthopedic surgeon and surgery involving plates and screws being inserted and then ongoing time off work to allow recovery.

The insurer was again MLC and the result was the same. Very professional and empathetic treatment by a claims manager at MLC and the financial result is that David is recovering physically with the bills being paid by Income Protection benefits while he does.

Both these gentlemen have thanked me profusely for persevering with them and they now realise that incidents like this DO happen to fit and healthy people. You can’t plan for the injury but you can make arrangements so that an accidental fall won’t have the same effect on those nearest to you or your financial well-being.

Income Protection insurance is designed to replace the salary/income of a person who is injured or becomes ill and is unable to continue to perform their work duties. It is designed to replace 75% of income on a short, medium or long term basis for a defined period of up to 2 years, 5 years or up to Age 65 after a certain waiting period; most commonly 30 days.