Since 2010 we’ve helped over 10,000 tradies and builders with their public liability insurance needs.

We’ve also dealt with hundreds of successful claims and picked up a few awards along the way.

No matter how simple or complex your business may be, we can assist with your public liability and all other business insurance needs.

As insurance brokers we have access to dozens of insurers and can do the shopping around for you, and as Australia’s most awarded trade insurance specialists you can trust us to get the job done right.

To get started hit the button below or call us on 1800 808 800.

If your business is a little more complex or you require advice on your insurance, our qualified brokers are here to assist.

In addition to public liability insurance we can also assist tradies with a wide range of policy types to cover all aspects of your business.

It doesn’t matter if you’re a sole trader, subcontractor, a small or large business, we can help you out with what you need.

Trust the experts to look after your insurance needs. Click here for an online quote or call us today.

Public Liability Insurance Guide

Having assisted over 9,000 tradies with their public liability insurance, it’s fair to say we know a thing or two about it!

We’ve put together a mammoth guide all about public liability for tradies. We’ll cover the following topics:

- Public Liability for Tradies

- How Much Public Liability Do I Need?

- What is Public Liability Insurance?

- Which Insurers do we Recommend?

- Pubic Liability Claims

- Public Liability Insurance Cost

- Cover for Tradies

- Tradies Love Trade Risk!

- Choosing Public Liability

- Public Liability Insurance Quotes

If there’s anything we haven’t answered in this guide, please call us on 1800 808 800 and our friendly team of experts will be happy to answer your questions.

Public Liability for Tradies

There are two types of people who come looking for public liability cover. Those who want to protect their assets in case things go wrong, and those who don’t care but just need the cover for their job.

It doesn’t matter which category you fall into, because we can help you either way.

Public liability insurance helps you by covering the costs of a claim made against you for property damage or personal injury caused by your activities.

A simple claim may just be a few grand to replace the carpet you accidentally ruined, but a more serious claim could result when someone falls into the ditch you’ve just dug and breaks their neck.

These claims can run into the millions of dollars, and without the right cover most tradies would be sent bankrupt, losing everything they’ve ever worked for.

The cover is a lot cheaper than you might think, with policies available from just $40 a month.

Don’t risk working without insurance – it’s just not worth it.

How Much Public Liability Do I Need?

This is such a common question, but also one that doesn’t have an easy answer.

The minimum amount of cover available is $5 million, so if you simply want the cheapest price, this could be the option for you.

The same is true when it comes to licensing. Of all the different trade licenses in Australia (electrical, plumbing etc.) we’ve never seen one with a minimum requirement higher than $5 million.

However some contracts will require that you have a higher level of cover.

For example some builders require that their subcontractors have at least $10 million cover, and if you’re working in shopping centres or other public areas your contract may stipulate $20 million cover.

The best way to find this out is to look at your contracts or simply ask those you are contracting to.

If you’re not entering into such contracts with others and are simply doing your own jobs, then the amount of cover is really up to you.

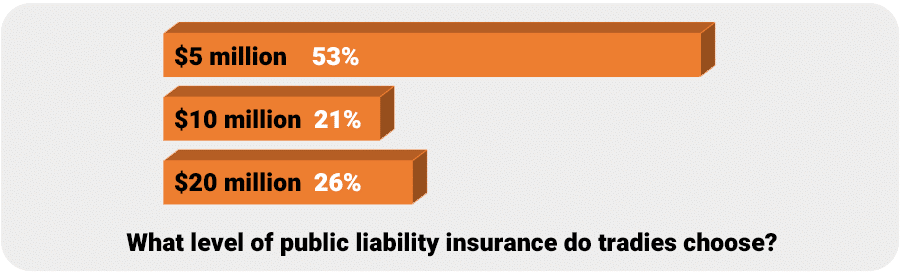

To assist in this area we’ve taken a look at how much cover tradies typically choose when purchasing public liability insurance through Trade Risk.

Our figures show that 53% of tradies choose $5 million public liability insurance, 21% choose $10 million and 26% choose $20 million.

Whilst most go with the minimum, close to half choose a higher amount and over a quarter take the maximum coverage.

Keep in mind that these stats are from tradies buying public liability insurance via our website. For our larger clients who deal more closely with us rather than buying online, we’d expect the results to be different with more choosing the higher levels of cover.

Which option you go with is really up to you, but remember that it doesn’t cost a whole lot more to go with more cover. For example doubling your cover from $5m to $10m will be nowhere near double the price.

The best option, assuming you don’t have any contracts stipulating a minimum amount, is to get quotes on each amount and decide for yourself which is more suitable for your needs and your budget.

For more information check out our guide: Is public liability insurance compulsory?

What is Public Liability Insurance?

Public liability is designed to protect you and your business in the event that you cause property damage or personal injury to another person.

With most trades involving a lot of manual work, the risk of personal injury and property damage is high, and that’s what makes this insurance so important.

If you are found to be responsible for damage or injury to another person due to negligence, you will be responsible for all of that person’s costs.

This could include the cost of repair or replacement in the case of property damage, whilst for personal injury it could include anything from medical expenses through to lost income and other forms of compensation.

These costs can be financially devastating for a tradesman and his business, and a serious claim could easily send you bankrupt. With public liability insurance in place you can rest assured that a claim will be looked after without you having to endure financial hardship.

Which Insurers do we Recommend?

As insurance brokers we have access to dozens of different insurance companies that we use and recommend.

Many of our clients fit with the big mainstream insurers. These are companies you might have heard of, such as Allianz, QBE, Vero etc.

Some of our clients undertake work that sits outside of what is considered normal for their trade, and in that case we sometimes have to go to specialist underwriting agencies.

These agencies often specialise in higher risk business activities or locations, and are only accessible via insurance brokers. This means you can’t approach them yourself, and you need to go via a broker such as Trade Risk.

Your public liability insurance will almost always be more expensive if we have to cover you through a specialist underwriter, but at least you know you’re getting a policy that fully covers your activities and the locations you work in. There’s no point having a cheaper policy if it’s not going to cover you at claim time.

Public Liability Claims

We’ve dealt with hundreds of public liability claims from tradies over the years.

Plenty have been tiny claims under $1,000 each, whilst some of the more serious ones have been up in the six-figure range.

Our data up to 2019 shows that the average claim amount for public liability insurance is $6,167. This for actual claims paid, not just those which have been lodged.

A six-figure claim would be enough for most people, but we’ve heard of one claim for an electrician (through a different broker) which is over one million dollars!

Without insurance those clients would face almost certain financial ruin, but with public liability insurance not only is the cost of the claim covered, but also the legal costs throughout the claim. It’s an absolutely life-saving (in financial terms) form of insurance for tradies.

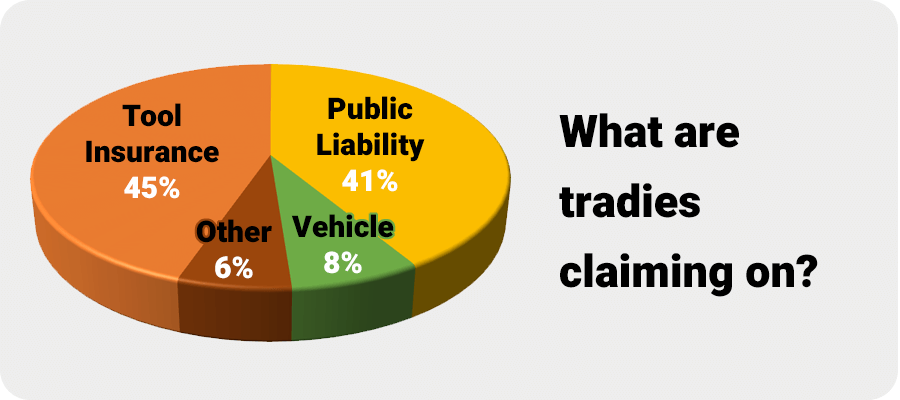

Our data shows that 41% of claims paid for Trade Risk clients are on their public liability insurance.

Whilst tools have a higher percentage in terms of the number of claims (45%) the average claim size for public liability is higher, and the overall dollar amount paid for public liability is higher.

Whilst virtually all tradesmen will insure their vehicles, our data shows that our clients are far more likely to claim on public liability rather than vehicle insurance.

Small Claims

Small public liability claims from tradies typically involve property damage rather than personal injury.

For example you might put your foot through a ceiling and need to cover repairs and repainting, or you might scratch a kitchen benchtop and need to cover the cost of repairs.

These types of claims can range from under a thousand dollars through to a couple of grand.

To start with you would speak with Trade Risk and lodge a claim form. We’d then submit the claim to the insurer, who would then come back to us with information on what’s going to happen next.

For a very simple claim they might only require a letter of demand, some information about what happened and a couple of quotes for repairing the damage.

If it’s a little more serious, they might appoint a solicitor to speak with you, or an assessor or loss adjuster to take a closer look at things.

Provided that you cooperate with us, the insurer and any third parties that have been appointed, the process for a small or even medium sized claim is generally quite straightforward.

The decision to pay a claim is always up to the insurance company or underwriter, and whilst we at Trade Risk can’t make the decision, we will certainly push them if we don’t agree with the direction a claim is heading in.

It’s important to remember that as your broker, we are legally required to act on your behalf, and not on the insurer’s behalf. What does that mean? It means we’re on your side!

Is it worth making a small claim?

As a broker we deal with dozens of different insurers with varying levels of excess. For some policies it’s $250, for many it’s $500 and for some higher risk occupations it can be higher.

For claims worth a couple of thousand of course it’s always worth lodging a claim. That’s what you have insurance for after all.

When it comes to claims worth less that a thousand dollars it’s worth thinking about first. Now we’d never discourage someone from making a claim, and when your excess is $250 or $500 it seems to make sense to lodge a claim for anything worth $500 or more.

Whilst there’s no such thing as a ‘no claim bonus’ or ‘rating one’ for public liability, like there often is for car and home insurance, the insurance companies will still look at your claims history when pricing your insurance.

If you’re had one or two average claims over the last couple of years it’s no issue, but if you’ve lodged a few claims every year for the last few years, the insurer is going to start to question your premium.

Think about it this way… Say your annual premium is $600, which is pretty typical for a tradie’s public liability. You lodge two claims every year for around a grand each, which after taking into account your $500 excess works out to around $1,000 per year in costs for the insurer.

If they start to know that you’re going to cost them $1,000 a year in claims, but they only charge you $600 a year, why would they guarantee themselves another loss? Instead, they’ll charge you a higher premium to reflect your higher cost.

So it’s just something to think about with those smaller claims. If you haven’t made a claim for a couple of years, by all means go ahead and claim! But if you’re making a couple of claims every year, it might be time to reconsider how you’re going about things.

Larger Claims

Larger public liability claims from tradies could be from say ten or twenty thousand, through to hundreds of thousands. We’ve never had a claim in the millions, but we know of others who have.

The process for a larger claim is still quite similar to that of a small claim to start with. You’d let us know, we’d let the insurer know, and the insurer would likely appoint a solicitor and other professionals to investigate the claim.

In some respects the insurer’s aim is the same as yours. They would rather prove that you weren’t at fault. After all, if the insurer can prove you weren’t at fault, then there is no claim to be paid! So at this point it’s definitely in your best interests to cooperate.

If it is clear that you were negligent and are responsible, the insurer will then be looking to settle the claim for the lowest cost whilst still keeping all parties satisfied.

As with smaller claims we at Trade Risk have no input into the decision to accept or decline a claim, but we’re always on your side and will be pushing for the best outcome for you as our client.

We certainly hope that you’ll never have to deal with a larger claim, but it’s good to know that if something serious does happen you have the right cover and the right team to handle it.

Public Liability Insurance Cost

The cost of public liability insurance for a trade business will depend on a variety of factors as follows:

- Your trade or occupation

- The size of your business (by staff numbers or revenue)

- Subcontractor use

- The level of cover required ($5m, $10m or $20m)

- Any high risk activities or work locations

The first factor is your trade or occupation, or more specifically your business activities.

Most of the standard residential trades will have a very low public liability cost, as their level of risk isn’t particularly high. But a higher risk occupation, such as welding, will have a higher premium.

In recent years plumbers have seen large increases in their public liability cost due to poor claims performance.

The size of your business will also have a major impact. Some insurers measure this by the size of your revenue, whilst other use your staff numbers. Either way, the larger the business, the higher the premium will be.

Why is this? Generally speaking, the more tradespeople who work in your business the greater the chance of an incident occurring that may result in a claim.

So a small business with just one or two workers on the tools will have a very low premium, whilst a larger business with ten, fifty or hundreds of workers will have a correspondingly higher premium.

The use of subcontractors will have an impact on the cost of your public liability cover. This varies from one insurer to the next, but generally speaking, the greater percentage of your revenue that is paid to subcontractors or labour hire, the higher your insurance cost will be.

The insurers take the view that you have less control over subcontractors compared with your own staff, so their may be a greater risk of a claim occurring. Claims can also get trickier where multiple contractors and subcontractors are involved, so the higher premium reflects the greater potential claim costs.

How much cover you require will impact your premium, but not by a great deal. For example doubling your cover from the minimum $5 million to $10 million will cost you nowhere near double the premium. Likewise doubling from $10m to the maximum $20m will not double the premium again.

High risk activities or work locations are the real wildcard when it comes to the public liability insurance cost for a trade business.

You might be a small electrical contracting business, fairly normal in most ways, but as soon as you tell the insurer you undertake work on a mine site or airport for example, the cost of your insurance could easily double or triple.

This is simply due to the higher risk of these locations. A claim involving mining equipment or at an airport could be many times larger than a claim involving a residential or light commercial property.

It’s important to tell us everything about your business activities so that we can get the right price for you. There’s no point withholding information to get a cheaper premium, if it means at claim time you’re doing to be declined anyway.

As a broker it’s out job to shop around and find the most competitive public liability insurance premium, provided that the cover still meets your business needs. Why shop around yourself when we can use our many years of experience in the trade to do the job for you?

Cover for Tradies

Although public liability is available for many different occupations and industries, it is the trades industry that relies most heavily on this form of cover.

Tradesmen are exposed to greater risks than most workers, and due to often being subcontractors or running their own businesses, the financial risks can be huge.

Insurance can take away that financial risk by covering the costs of action taken against you to recover funds. Sometimes this will be the result of court action, and other times it can be a simple agreement between the parties.

The consequences of major action against you and your business can be financially devastating, so it’s definitely worth investing a dollar or two each day to pass your financial risk onto a big insurance company rather than having to settle a claim out of your own pocket.

Tradesman insurance can include more than just public liability, but it is certainly one of the most important covers, and the one that most tradesmen can’t do without.

Not a tradie?

If you’re not a tradie you probably wouldn’t have read this far into the article!

Whilst tradies and trade-related businesses make up the vast majority of our clients, we do assist a range of other business types that have ended up as clients over the years.

These clients include cafes, medical centres, retailers, consultants and more.

To see how we can help your non-trade business, please visit PATCH Insurance.

They have plenty of articles aimed at non-trade businesses and can also help with a quote when you’re ready.

Tradies Love Trade Risk!

Every tradesman who purchases an public liability policy from us will be asked to rate and review our service.

We do this because we care about what our clients think, and we do everything we can to ensure we’re the best at what we do.

As part of this, we use the global review agency Feefo to gather independent ratings and reviews from our clients.

In 2017 (and again in 2018 and 2019!) this culminated in Trade Risk being awarded a Gold Trusted Service Award from Feefo.

We’re super proud of this achievement, and we thank our thousands of happy clients for leaving such positive feedback for us.

Click here to read through some of the hundreds of reviews that have been left for us by our happy tradie clients.

Choosing Public Liability Insurance

What should you look out for when choosing a policy?

Most tradies will look at price first, and because many policies are quite similar from one insurer to the next, this isn’t a bad place to start.

The premiums can vary greatly between insurers, and often the features and benefits between each insurer are not too dissimilar.

Price isn’t everything however, and there are a few other factors to look at. When choosing a public liability provider, we recommend using an insurer with a strong and reputable name that you know will be there when you need it.

Whilst most policies are very similar, there are a few extra features and benefits to look out for. Some policies include tax audit cover, which can help to cover the costs if your business is subject to an ATO tax audit. The likelihood of being audited may be fairly low, but the costs can be very high if you are targeted by the tax office.

One of the best ways to choose the right policy is to use an insurance broker who specialises in your industry.

Here at Trade Risk we specialise in tradesman insurance, and our network of tradesman insurance specialists can help to find you the cover that is going to suit you and your business.

For more information or to get a quote on your public liability insurance please follow the links to our free online quote request.

The Expert’s Opinion

Do you care about you and your family’s financial security? If the answer is yes, then public liability insurance is an absolute must.

There are a million things that can go wrong on the worksite. Some of them you can control, but there are some events that no amount of planning or care can stop from happening.

If one of these events resulted in major damage to a property, or in major injury or death to someone, the financial impact on your business and your family can be absolutely devastating.

It is events like this that have sent many tradies and their businesses into bankruptcy. Financial problems can also lead to relationship problems, and suddenly a problem on the worksite can bring your whole world crashing down.

For the sake of $50 (or less) per month you can protect yourself from all this trouble by taking out a decent policy. The application process is easy, and it may well be the best investment you make in your business.

You may get through your whole working life without ever going through a serious liability claim, but if you do, you’ll be glad you had the right cover in place. The alternative just isn’t worth thinking about.

Contact Trade Risk today to find out how inexpensive public liability insurance could be for you and your trades business.

Public Liability Insurance Quotes

If you’ve read this far you surely understand just how important public liability insurance is for a tradie!

It’ll take less than 20 seconds to get a quick quote from Trade Risk, and only minutes to go ahead and purchase a policy.

For those of you who still prefer good old fashioned service you cal always call our office on 1800 808 800.

We employee qualified insurance brokers who will be happy to run through everything with you and make sure the cover is right for you.

Author: Shane Moore. Last updated: 05/06/2023.