We specialise in sole trader insurance and have helped thousands of self-employed tradies with their business insurance needs.

Whilst we also look after plenty of larger businesses, sole traders and one-person companies are where it all started for us.

The Trade Risk difference is that we provide a high level of personal service to all clients no matter how small or large your business is. That’s just one of the reasons why we’ve received multiple awards for our service.

If you’re a sole trader looking for quotes or advice on your business insurance, hit the button below or call us on 1800 808 800.

If it’s information you’re after at this stage, continue reading for our in-depth guide on sole trader insurance.

Sole Traders Insurance Guide

Insurance Types

- Public liability insurance

- Personal accident insurance

- Tool insurance

- Commercial motor

- Professional indemnity

- Business pack

These are the most common forms of sole trader insurance, and the ones we’ll be covering in this guide, but there are other forms of cover that we can assist with at Trade Risk.

Along with detailing the different types of insurance available to sole traders, we’ve added a new section to this guide which looks at different business types and their insurance requirements.

You’ll find our sole trader insurance requirements guide towards the end of this article.

Being a Sole Trader

Operating as a sole trader is certainly the easiest way for a tradie to become self-employed.

Whether you’re subcontracting to others or running your own jobs, being a sole trader is a cheap and easy business structure for a tradie to go with.

There are some downsides however, and one of those is that you and your business are treated as one and the same.

If your business suffers a loss, perhaps as a result of being sued, you are personally liable for that loss.

This differs to a Pty Ltd company structure, where the loss is generally contained within the company.

If something goes wrong in your business as a sole trader, there is nothing to protect your assets such as your family home.

This means it is arguably even more important to have the right sole trader insurance in place, and especially public liability insurance.

Our experience with sole traders

What do we know about sole traders insurance? Quite a lot!

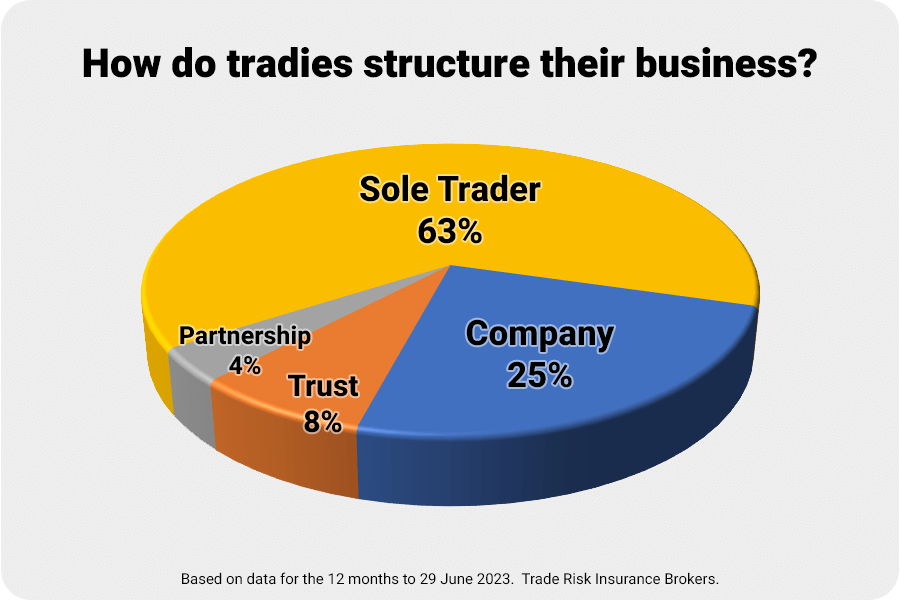

We assist thousands of clients with their trades insurance needs, and our data shows that most of them are indeed sole traders.

Our most recent data up to June 2023 shows that 63% of tradies are structuring their business as a sole trader.

Many of our clients who start out as sole traders do make the switch to a company or trust structure at some point, and we can easily facilitate the changes needed to your insurance.

If and when you do switch up from a sole trader, you won’t need to find a new insurance broker. We can help throughout your entire business journey.

Sole Trader Insurance Types

There are many different types of cover which can fall under the sole trader insurance category.

Public liability insurance is a big one, and for tradies there are your tools and your ute or van that need to be protected.

Depending on how complex your business is there may be other needs, but for now we’ll stick with the main cover types.

Public Liability Insurance

Public liability is the most important form of sole trader insurance, and the one you’ll most likely be asked about.

This is the insurance that could well save your family home and other assets in the event that you are sued over property or personal damage.

Your public liability policy will respond in the event that you cause property damage or personal injury to a third party.

At the low end, this could be basic property damage caused to a client’s home or contents.

At the high end we have claims involving personal injury. If your negligence was to result in the death or serious injury of another person, you could be liable for hundreds of thousands, if not millions of dollars.

Even the lowest amount of cover for public liability is $5 million, which can give you the peace of mind knowing that you are protected if things go wrong.

If you feel you need greater protection as a sole trader, cover amounts of $10 million and $20 million are also available.

Why do sole traders need public liability insurance?

Public liability insurance is important for all self-employed tradies operating under any business structure, but it could be argued that it’s even more important for sole traders.

As a sole trader, you and your business are legally a single entity. This means that any action taken against your business is taken against you.

Why does this matter? Well say you’re working in someone’s home as a carpenter, and you do something which results in an injury to someone living in the home.

You’ll be responsible for any costs relating to that injury, which could be anywhere from a few hundred dollars through to hundreds of thousands of dollars if it’s very serious.

If you were operating as a Pty Ltd company, it would be that entity that would be liable and potentially dragged through the courts.

Ideally your company would have public liability and everything would be fine, but say you didn’t have insurance and couldn’t cover the cost of the claim, at least your personal assets such as your home couldn’t be pursued.

But as a sole trader your personal assets aren’t separated from your business. So if you didn’t have insurance and couldn’t cover the costs of the claim, you could potentially lose your house or other assets to settle the claim.

The thought that one single mistake could cost you your house should be incredibly scary for any tradie operating as a sole trader.

What does public liability insurance cover?

By now you should have a bit of an idea. Basically it covers self-employed people in the event that your business activities result in property damage or personal injury (including death) to a third party.

A third party could include your client or a member of the public, but does not include yourself or your staff.

A minor property damage claim could involve an electrician working in a roof, who accidentally puts their foot through the ceiling.

No one is injured, but the cost of repairing the plaster and painting the ceiling could end up being a couple of thousand dollars.

You might choose to claim this through your insurance, or you might have some mates in the trade who can cover the plaster and painting for less than the cost of the excess.

More serious claims tend to involve personal injury or death.

Let’s use the electrician example again, but in this case instead of putting his foot through the ceiling, he’s left some cables running through the hallway.

An occupant of the house didn’t see the cables, and she’s tripped over them, breaking her wrist and hitting her head in the process.

The electrician will be liable for any medical bills, lost wages and any other damages that may be awarded by a court.

These costs could easily make their way into the tens of thousands, or potentially more depending on the severity of the injuries.

Provided that the electrician is found to have been responsible for the injuries as a result of their negligence, their public liability insurance policy will cover the costs of the claim including the legal expenses.

How much is public liability insurance for a sole trader?

There are two main factors that affect the cost of public liability insurance. These are the size of the business and the activities of the business.

When it comes to size, as a sole trader you’re typically a one-person operation, which puts you at the lowest end of the scale when looking at cost.

Then it’s the business activities to be considered, and how much risk is involved.

If you’re a sole trader carpenter working only on residential projects, the risk will be considered to be quite low and therefore the cost will be quite low.

In this case we’d be talking well under $1,000 per year for $5 million cover, which is very cost effective.

If you’re a sole trader, but you’re undertaking electrical work in a substation on a mine site, the risk is considerably higher and therefore the cost will be considerably higher.

Some insurance companies will rate the size of your business based on the number of staff, whilst others will base it on your annual revenue.

For those that rate on revenue, keep in mind that the public liability insurance cost won’t change too much for any amount of revenue below $150,000 per year.

So whether your annual revenue is $75k or $125k, you probably won’t notice much difference in premium, if any.

Can I get public liability insurance as a sole trader?

You don’t need to be a registered company to have public liability insurance, so yes, sole trader can have public liability insurance.

In fact, public liability insurance is arguably more important for a sole trader than any other self-employed business type.

How do I insure myself as a sole trader?

As a sole trader your public liability insurance will be held under your personal name, with the option to add your business name.

The insurance itself is really no different irrespective of whether you’re a sole trader or company, but it is vital to ensure that the insured name on the policy is correct.

Any errors in the insured name have the potential to cause issues at claim time.

A good broker will generally take the time to search your ABN, which will help to ensure the correct entity name is being used.

Does a sole trader need an ABN to hold public liability insurance?

The insurance companies don’t have specific rules that require a sole trader to hold an ABN.

There are certainly reasons why a sole trader should hold an ABN, but it doesn’t specifically relate to insurance.

For more information check out our article on does a sole trader need an ABN.

For a quote on sole trader public liability insurance, click the button below or call us on 1800 808 800.

Personal Accident Insurance

Although not technically business insurance, personal accident is a vital form of sole trader insurance.

Many tradies refer to this type of insurance as income protection, which is very similar, but income protection is sold via financial advisers, whilst insurance brokers (such as Trade Risk) deal in personal accident.

As a sole trader you don’t have anyone to rely on for paid sick leave, and depending on the state you operate in, you might not have access to workers compensation either.

That leaves personal accident insurance (with optional sickness cover) as the only way to protect yourself financially if you’re self-employed and unable to work due to injury or illness.

Personal accident and sickness can cover up to 85% of your income for a period of time whilst you are unable to work due to injury or illness. The length of time payments will continue for depend on the options you select when setting up the policy.

To request a quote on personal accident insurance for sole traders, please click the button below or call us on 1800 808 800.

Tool Insurance

Any tradesman operating on their own is going to need a solid collection of tools and equipment.

It is this gear that you rely upon in order to make a living, so if anything was to happen to it, you need to get it sorted quickly.

Sadly, tool theft in Australia is rampant. At Trade Risk we deal with multiple tool insurance claims every week from tradies who’ve had their gear taken.

Just like you insure your house or your car, sole traders can also insure their tools and equipment.

Tool insurance for sole traders can cover you gear for a range of risks including fire damage, damage caused in a vehicle collision and theft following forced or violent entry.

When purchasing tool insurance it’s vital to check for any item limits on the policy.

Some policies will only cover items over a certain value if they have been specified on the policy. This amount is typically $3,000 or $5,000 depending on the insurer.

One of our more popular tool policies won’t cover any single item with a replacement value over $5,000. For some people this is no problem, whilst for others it means the policy is not the right fit for them.

Please note that we can only provide tool insurance when combined with a public liability policy.

Commercial Motor

The majority of tradies operating as sole traders run their business from home with a ute, van or truck.

In the case of utes especially, often these double as the tradies main form of transport rather than being a pure business vehicle.

For this reason we often find that sole traders have their ute or van insured through a typical car insurance provider such as NRMA or AAMI etc.

Whilst these are fine insurance companies, you need to check if you are properly covering your vehicle for business use.

Furthermore, you need to check what you’re actually covered for.

Policies through the big retail insurance companies are great for the typical commuter, but can fall well short when it comes to business use.

For example if your ute or van has a few grand worth of fit out, such as boxes, racks and shelving etc, these might not be covered under a standard policy.

It’s a similar story with signage. Some of these policies might cover a few hundred dollars of signage if you tell them it’s for business use, but they generally won’t cover your $4,000 wrap.

This is where a proper commercial motor insurance policy can help.

Your broker can work with you to ensure the true cost of your vehicle is covered. Not just the vehicle itself, but the thousands of dollars’ worth of modifications you shelled out for.

For a quote or more information please use the buttons below or call us on 1800 808 800.

Professional Indemnity Insurance

The majority of sole traders working in the trades will not require professional indemnity insurance, but that doesn’t mean you shouldn’t know about it.

Professional indemnity is in some ways similar to public liability, but instead of covering your physical activities it is more about advice based activities.

So who needs it then? Essentially any sole traders who provide advice for a fee.

If for example you’re a carpenter and you provide advice to a homeowner as part of some building work you’re doing, this is most likely not going to need professional indemnity cover.

But if you’re a carpenter and you’re going out providing written reports to homeowners, and they’re paying you for that service, then you should definitely be considering professional indemnity.

We strongly recommend speaking with one of our insurance brokers to determine if this type of cover might be right for you.

Business Pack

Although sole traders are typically home and vehicle based, there are some who’ve taken the next step and have their own premises.

It may be a small warehouse, office or even retail space. Either way you need to ensure the premises and everything in there is properly insured.

If you’re renting the premises, your lease will most likely require that you hold public liability of $20 million and glass cover.

These are both quick and easy (and relatively inexpensive) to setup, and we can issue the certificate of currency that the property manager or owner will require.

If you’re lucky enough as a sole trader to be purchasing your own premises, we can also assist with insuring the building itself.

Then you’ll need to insure whatever is in the premises. This could be stock, machinery, furniture, computer equipment or whatever else your business needs to run.

All of these different risks (and many more) can be insured under a single business pack policy via Trade Risk.

We recommend speaking to one of our insurance brokers if require a business package. Call us on 1800 808 800, or complete the form using the button below and one of our brokers will contact you.

Sole trader insurance requirements

The types of insurance required for a sole trader will vary depending on the business activities you are undertaking.

Although it seems easy to bunch all sole traders into a single group, the range of different business activities undertaken – and the risks involved – vary hugely.

The insurance types we have detailed below aren’t necessarily mandatory for a sole trader, but are what we consider the minimum requirements for a business owner wanting some level of protection.

When it comes to mandatory sole trader requirements, typically this is linked to state licensing.

For example, licensed electricians in Queensland must have public liability insurance and consumer protection insurance.

It’s a similar story with licensed Victorian plumbers needing public liability insurance along with plumbers warranty cover.

Certain professions will also have mandatory requirements for professional indemnity insurance.

Getting back to those covers we consider to be important for a sole trader, we’ll split into a few different groups to get started.

Trades & Services

When we talk about trades and services, we’re typically talking about physical work.

This could be a tradesperson, a handyman, a cleaner, or any occupation or business type that involves physical activity.

Two of your biggest risks here are causing injury or property damage to others, or injury to yourself.

As a manual worker you may have certain tools or equipment that is required to undertake your job. So there is an added risk that your gear could be stolen, and as a sole trader if you can’t work, you’re probably not going to be earning any money.

Public liability insurance:

Provides cover for property damage of personal injury that you cause to others.

Personal accident insurance:

Provides cover for an injury or illness that leaves you unable to work for a period of time.

Tool insurance:

Provides cover in the event that your tools or equipment are stolen or damaged (depending on the policy options).

Retail

In the retail business there are many risks, but two of the largest are that your products cause personal injury or that someone suffers a personal injury whilst on your premises.

If you have leased premises you’ll most likely find that public liability insurance and glass insurance are requirements on the lease.

Public liability insurance:

Provides cover if someone suffers a personal injury whilst on your premises. Typically referred to as ‘slip and fall’ incidents.

Product liability insurance:

Provides cover in the event that your products result in personal injury or property damage to a third party.

Contents and stock insurance:

Provides cover if your stock is damaged by fire or other perils. Cover can also be provided for theft of your stock.

Professional Services

Switching to professional services, we’re now talking more about professions that involve the provision of advice rather than physical exertion.

When it comes to sole traders, we could be talking about bookkeepers, therapists and other service providers.

Whilst there is a risk that someone could injure themselves on your premises, typically the greater risk is that you advice or service is negligent and results in a financial loss.

Professional indemnity insurance:

Provides cover in the event that your advice or service results in a financial loss to your client.

Public liability insurance:

Provides cover in the event that a client (or any other visitor) injures themselves whilst on your premises.

Warning:

The above list of requirements is by no means exhaustive and does not take into account the individual circumstances and needs of each different business type.

We strongly recommend speaking with one of our qualified small business insurance brokers to discuss your risks and your insurance needs.

Why choose Trade Risk?

Sole trader insurance really is our bread and butter here at Trade Risk.

We insure over 4,500 self-employed tradies, and the majority are either sole traders or single-person Pty Ltd companies.

Of course we also insure some much larger trade businesses, and that’s what allows us to grow with you as your business becomes larger and more complex.

We’re also a Business Class supporter of Flying Solo, which is a great resource and community for sole traders and small business owners in Australia.

We understand the needs of sole traders and small businesses working in the building and construction industry.

It doesn’t matter if you just need a cheap public liability policy or a more comprehensive sole trader insurance business package and advice. Trade Risk have the right team in place to look after you.

The beauty of Trade Risk is that we can help you whilst you’re a sole trader, and can continue to help you as your business grows and evolves.

Whether your sole trader business becomes a partnership, a Pty Ltd company or a family trust, we can adjust your policies as needed to keep pace with your business.

For more information please call us on 1800 808 800 or contact us online.

To get started on a quote please click here or call our office to speak with a broker.

Not a tradie?

If you’re not a tradie but still need insurance, please visit our good friends at PATCH.

Their sole trader insurance guide covers everything you need to know, and they can assist with quotes and advice.

Author: Shane Moore. Last updated: 24/01/2024.