Setting up as a sole trader is a common way for tradies to start their business.

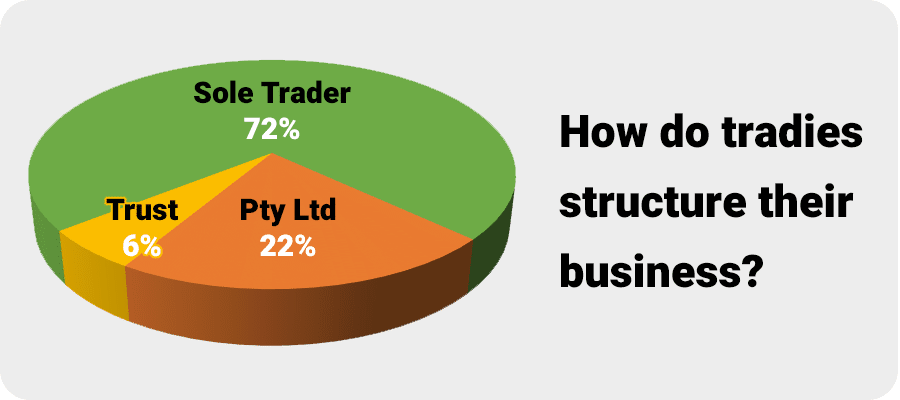

Our data shows that over 72% of tradies start their business with this structure.

Whilst we’ve all heard the term, what does being a sole trader actually mean?

In this guide we’ll answer the question of ‘what is a sole trader’ as well as looking at some common questions and misconceptions.

- Sole trader definition

- Common misconceptions

- Can a sole trader have employees?

- Can a sole trader have a business name?

- Can a sole trader have two ABNs?

- Why use a sole trader structure?

- Sole trader insurance requirements

Sole trader definition

A sole trader is an individual running a business. They own and manage the business, and both the individual and the business are a single entity.

The Australian Taxation Office (ATO) defines a sole trader as an individual running a business.

“If you operate your business as a sole trader, you are the only owner and you control and manage the business.”

“You are legally responsible for all aspects of the business. Debts and losses can’t be shared with other individuals.”

Perhaps the easiest way to differentiate a sole trader is the fact that they share a single Tax File Number (TFN) between themselves and their business. They are a single entity.

Common misconceptions

There a few misconceptions amongst tradies starting a new business.

First up, the term sole trader relates to a specific business structure rather than being a blanket term for any tradie who operates on their own.

For example some tradies operate their business as a Pty Ltd company. This may have been recommended by their accountant for various reasons.

In this case your business is a company, not a sole trader, even if you’re the sole person involved in the business.

Sometimes we hear of tradies who think they don’t need an ABN if their revenue is less than $75k a year.

They are confusing ABN registration with GST registration. All businesses will need an ABN regardless of revenue, but you’ll only need to register for GST if you expect your annual revenue to exceed $75k.

Another misconception is that being a sole trader means you have no staff. This is not true, as you can operate as a sole trader whilst also employing staff.

We’ll cover the sole traders with employees in a separate section below.

Can a sole trader have employees?

Although it’s not particularly common, a sole trader can have employees.

We strongly recommend speaking with your accountant for further advice in this area, but you’ll most likely find that your accountant will recommend switching to a company or trust structure before you take on employees.

More information for sole traders employing staff can be found here.

Can a sole trader have a business name?

Absolutely. Being a sole trader doesn’t mean you have to operate under your own personal name.

The entity will always be your personal name, but you can still register a business name to use.

In this case your ABN would still be in your personal name, but with a business name attached.

On official documents, such as bank statements for example, both your personal name and business name would appear as follows:

John Smith trading as JS Elite Carpentry.

This would typically be abbreviated as follows:

John Smith t/as JS Elite Carpentry.

A sole trader can also have multiple business names if you operate multiple businesses. This leads us into the next question…

Can a sole trader have two ABNs?

A sole trader can only have a single ABN.

However, a sole trader can operate multiple businesses, with multiple business names, under a single ABN.

For example if you operated as a carpenter and a handyman, but for whatever reason wanted each business to have its own unique identity, you could do exactly that with a single ABN.

You might have two businesses as follows, for example:

John Smith t/as JS Elite Carpentry

and

John Smith t/as JS Handyman Services

Both would share the same ABN, but still have their own names.

In your marketing you would generally only use the business name rather than having your name and the “t/as” tacked onto the front.

If you absolutely want each business to have its own ABN, the only option is to have one or both businesses setup as a company. As each company is a separate entity, it would have its own ABN.

Why use a sole trader structure?

For a anyone starting a trade business, setting up as a sole trader will be the cheapest, fastest and easiest option.

It’s a DIY option that can cost virtually nothing to setup. The only cost will be if you wish to register a business name, and even that is only around $30.

Registering your ABN and registering for GST is free is you go directly through the Government’s online service.

Our data shows that 72% of tradies start their business as a sole trader, making it by far the most common option.

This isn’t to say being a sole trader is going to be the best option however. Whilst it is cheap and easy, there are also some important limitation of this structure.

We have a comprehensive guide on sole trader v company that goes in greater detail on the pros and cons of each option.

We also strongly recommend speaking with your accountant about the best structure for your individual needs and circumstances.

Sole trader insurance requirements

It would be remiss of us not to look at the business insurance side of what it means to be a sole trader.

As a sole trader your business insurance requirements are no different to that of a company or trust.

Your sole trader insurance policy will be in your personal name, with the option to add any business names you have.

It’s important to have your personal name on the policy rather than just your business name, as your personal name is the actual entity being insured.

For information specific to public liability, visit our sole trader public liability insurance guide.

More information

For more information about what a sole trader is, or whether or not it’s the right structure for your trade business, we recommend speaking with your accountant.

Whilst any accountant will be able to help you, we recommend using a tradie accountant who will have more knowledge about your specific industry and what works best for it.