You’ve finished your apprenticeship, you’ve done your time working for someone else, and now it’s time to set up your own business.

Going out on your own, even if it’s just to subcontract back to the same company, is a pretty exciting time for any tradesman.

There a few things you’ll need to do first though, and one of those is to choose a structure for your business.

There are a number of different structures available, but for most tradies the choice will be between operating as a sole trader or establishing a company.

In this guide we’ll cover the following questions and topics:

- What’s the difference?

- Sole trader – Pros and cons

- Company – Pros and cons

- Which is best?

- What do most tradies do?

- Other structures

What’s the Difference?

The biggest difference between the two structures is that as a sole trader you and your business are a single entity, which means you share a single Tax File Number (TFN) and Australian Business Number (ABN).

A company on the other hand is a separate entity with its own TFN and ABN.

What does this mean in practical terms? Well as a sole trader you (the proprietor) and your business are one and the same, which means if the business suffers a loss or is sued, you are personally liable.

With a company being a separate entity however, any losses stay within the company. So if your company suffers a loss or is sued, only the company’s assets can be accessed and not your personal assets.

There are some exceptions to the above rule where your personal assets can be at risk, but for a tradesman this is generally only the case where you have acted outside of the law.

The easiest way to tell the difference between a sole trader and a company is by their name.

A sole trader’s legal name will typically look like this:

- John Smith t/as John’s Carpentry Services

Whilst a company will typically look like this:

- John’s Carpentry Services Pty Ltd

Sole Trader – Advantages and Disadvantages

The main advantage of setting up your business as a sole trader is that it is much cheaper and easier than establishing a company.

The main disadvantage is the lack of personal asset protection that the sole trader structure offers.

Advantages

- Inexpensive and quick setup process

- Easy to understand structure

- One set of tax returns and accounting fees

- Potential tax benefits for low-income generating businesses

- No requirement for worker’s compensation if you employ no staff

- No requirement to make super contributions on your drawings

Disadvantages

- Personal assets are at risk if something goes wrong

- No access to income splitting (a potential tax strategy)

- Tax implications in the event of death or divorce

- Lack of flexibility for tax planning

- Once the sole trader dies or retires, the business ends

Company – Advantages and Disadvantages

One of the main advantages of operating your trade business as a company is that your personal assets are protected from any losses incurred by your business.

The main disadvantage, especially for a tradesperson running a small business on their own, is the added cost and complexity of the company structure.

Advantages

- Personal assets are protected from business losses

- Greater flexibility for tax planning

- Ability to bring on additional shareholders and raise capital

- Income can be split between family owners for tax purposes*

* Any strategies regarding income splitting should be discussed with your accountant to determine their legality.

Disadvantages

- More costly and time consuming to establish

- Additional accounting fees each year

- Can be costly when winding up the business

Which is Best?

The best option really depends on the type and size of business you are establishing.

If your intention is to simply work for yourself as a subcontractor to others, perhaps with a few of your own jobs on the side, then a sole trader structure may be adequate.

If on the other hand you are looking at employing a number of people and working on larger projects, especially where you need to take on larger liabilities, then a company structure may be more appropriate.

We recommend speaking with an accountant about which structure might be best for you. We’ve put together a great guide on choosing the right accountant for your trade business.

What Do Most Tradies Do?

We can’t talk for all tradies, but we can see how thousands of Trade Risk clients are structuring their businesses.

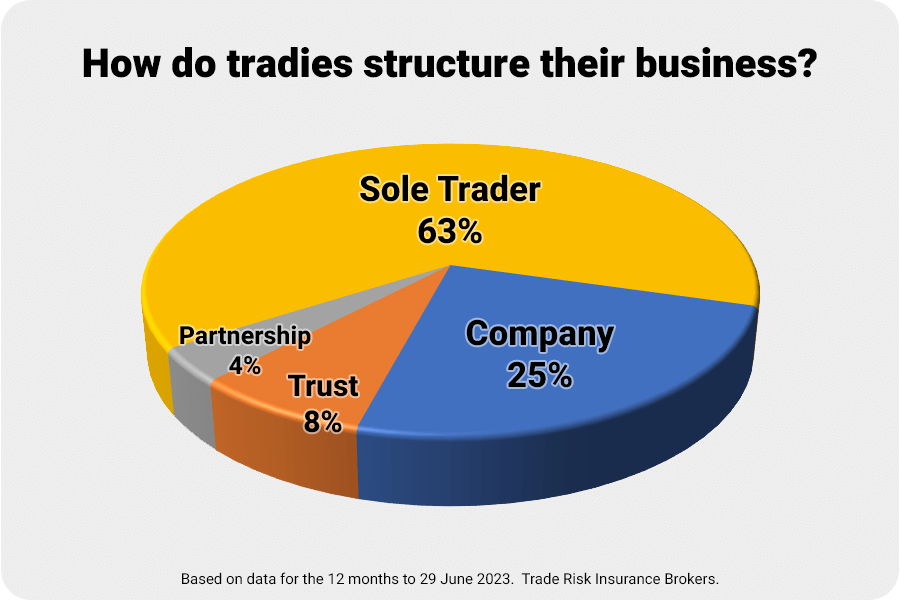

Our data shows that 63% of tradies operate as sole traders, 25% as a Pty Ltd company, 8% via a trust structure and just 4% as a partnership.

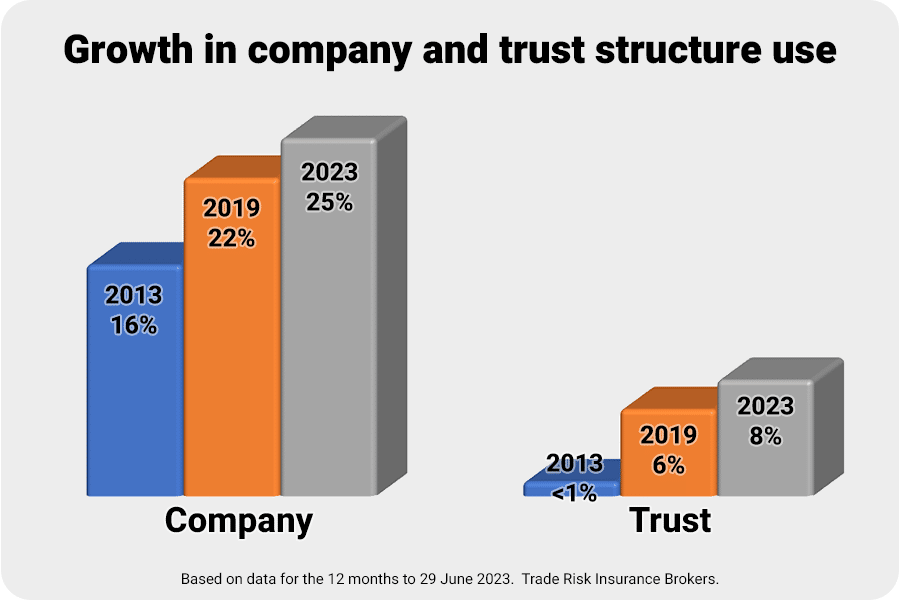

These figures are current at 2023. Since we first started tracking these numbers in 2013, there has been a clear growth in the percentage of tradies using company and trust structures.

Back in 2013 a huge 84% of our tradie clients operated as a sole trader of partnership. By 2019 it had reduced to 72%, and now in 2023 it is 67%.

The use of family trusts has grown significantly over that time. In 2013, less than 1% of our clients used a trust structure. By 2019 that grew to 6%, and now in 2023 it has hit 8%.

Whilst the sole trader structure remains comfortably the most common for tradies, it has certainly been reducing over the last decade.

Given that we deal with thousands of tradespeople from all over Australia, it’s fair to say that these percentages would be a reasonably accurate representation of the overall tradie population.

Why the change from 2013 to 2023? It could be that more tradies are going with the company or trust structure, or it could be that our clients’ businesses have ‘matured’ over the deaced and more have switched to different structures as they have grown.

Either way, the result is that most tradies still choose the sole trader option, but the trend shows they are moving to company and trust structures over time.

Other Structures

There are other structures available to tradespeople looking to start their own business.

We won’t go into them in great detail, but they include structures such as partnerships and family trusts.

For more information about the different structures available and their advantages and disadvantages we recommend that you speak with your accountant.

Insurance

Given that our business is insurance for tradies, it would be remiss of us not to mention insurance in this guide.

Generally speaking there is no difference in the insurance requirements of a tradesperson working either as sole trader or as a company.

The only real difference comes in the form of workers compensation. When you operate as a sole trader you are not classed as an employee of the business, so therefore you don’t have to pay worker’s compensation for yourself.

With a company however you can be classed as an employee of the business, and therefore you may be required to pay worker’s compensation based on your own wages from the business.

The rules differ slightly from state to state when it comes to companies with a single working director. For more information please visit our workers compensation guide.

Resources

We have put together a list of resources to help tradies when trying to decide which business structure is best for their new enterprise.

Business.gov.au – Choose your business structure

MYOB – Sole trader vs company: What are the key differences?

Qld Govt – Sole trader business structure

Advice Warning

There can be serious consequences in terms of taxation and asset protection down the track depending on which business structure you choose.

The information in this guide has been prepared as best we can, however it’s important to remember that we are insurance experts, not business experts or accountants.

We strongly recommend that you speak with your accountant about which structure is right for your personal situation.

Author: Shane Moore. Last updated: 29/06/2023.