Are you ready to start your own electrical contracting business?

So you’ve finished your apprenticeship, had enough of working for someone else and want to get out on your own.

Once you have your trade, and assuming you already have a decent set of tools, starting your own electrical business isn’t all that difficult.

In this guide we’ll help to point you in the right direction when getting started as a self-employed electrical contractor.

Topics covered will include:

Licensing

The first thing to consider before starting your own business as an electrician is your eligibility for an electrical contractors licence.

You’ll need to sort out your business structure and insurance before actually applying for your licence, and we’ll detail why shortly.

But first you need to actually make sure that you are eligible for a licence.

The license requirements and processes are slightly different in each state, so for now we’ll look at the basics rather than going into too much detail.

In some states, having your trade certificate isn’t quite enough to get your contractor’s licence.

In Qld for example you may need to complete a business course via TAFE or other suitable registered training organisation.

For more information on your eligibility for a licence we recommend contacting your state government office responsible for licensing. These contacts are detailed below:

QLD – WorkSafe – 1300 362 128

NSW – Fair Trading – 133 220

VIC – Energy Safe Victoria – 1800 815 721

SA – Website – 131 882

WA – Department of Energy – 08 6251 2000

TAS – Consumer, Building and Occupational Services

ACT – Environment, Planning and Sustainable Development

NT – Electrical Workers and Contractors Licensing Board – 08 8936 4079

Once you are comfortable with your eligibility, the next steps are to decide on a business structure and get some insurance in place.

This may feel like you are putting the cart before the horse, but in some states you must provide details of your business and insurance with your licence application.

Business structure

Getting your business structure right is a big deal. Although you can change it down the track, there could be tax consequences for doing so.

Most electricians starting out on their own do so as a sole trader. This is the cheapest and easiest option, but it is by no means the only option.

There are four main options when it comes to structuring an electrical contracting business:

- Sole Trader

- Partnership

- Company

- Trust

Choosing a business structure for your electrical contracting business could form an entire article on its own, and we certainly don’t have the space to run through all of the features and benefits of each option here.

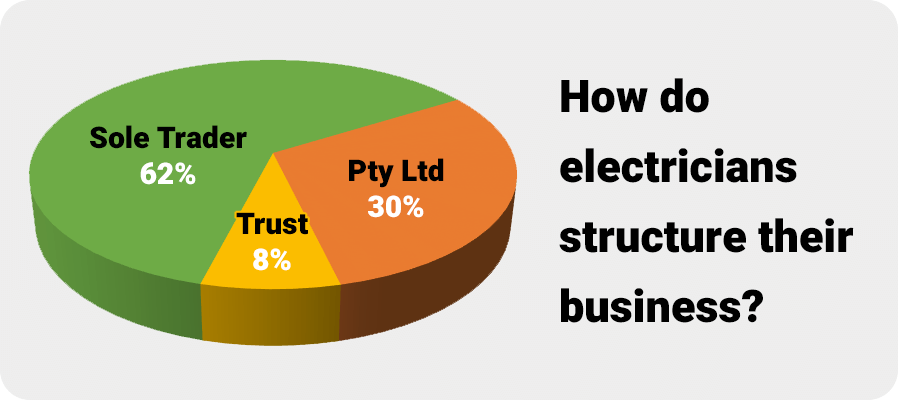

It is interesting to look at how other electrical contractors structure their businesses.

Data from our clients shows that 62% go with the sole trader option, 30% as a company and 8% via a trust structure.

Our data also shows that electricians are more likely to use a company or trust structure compared with other trades. Whilst only 28% of trades overall use a company or trust, this figure increases to 38% for electricians.

Why do more electricians prefer the company or trust structure compared with other trades? We’re not sure, but it may be that as a higher-earning trade there is more incentive to go with a more flexible structure.

It’s worth checking out our sole trader or company guide for more information, and we also recommend speaking with your accountant before deciding on a structure.

Insurance

Depending on the state you applying for your licence in, you may find that electricians insurance is one of the requirements for your licence application.

The type of insurance you need is public liability, and if you operate in Qld, you’ll need to include consumer protection insurance.

The minimum amount of public liability you require is $5 million.

You may find that once you get started some clients will require $10m or $20m cover (especially for large commercial jobs) but this doesn’t affect your licence requirements.

You can always get the minimum $5m to start with in order to get your licence, then bump it up as needed.

Our data shows that most electricians go with the minimum cover when buying their public liability online, but nearly half choose a higher option.

Note that the above stats relate to electricians using our online system for the first time. For the larger electrical contracting businesses we deal with, we’d expect the proportion with a higher level of cover to be much larger.

The cost of the insurance will vary depending on your state, but you’re generally looking at somewhere between $450 and $600 for the minimum insurance needed.

If you’re in Qld, you’ll need a special certificate of currency, whilst in all other states a standard certificate will do. Either way, it’s vital that the name on your insurance matches the name on your licence.

Don’t worry if you don’t get it right first time, as your insurance broker can always amend the name on your policy and issue a new certificate at no additional cost.

You might not be ready to take out insurance if you’re reading this, but we can help you out with an instant quote so at least you’ll know how much you can expect to pay for your public liability.

Click the button below if you’d like an instant quote, or you can call our team on 1800 808 800 for a chat about the various covers available and the costs involved.

Licensing – Part 2

Once you have your business structure in place and your insurance paid for, it’s back into the licence application process.

If you have all of the necessary paperwork in place, the application process is really quite straightforward.

You’ll need to get in touch with the state office responsible for licensing in your state, which we detailed earlier in this guide.

Accounting

Your bookkeeping and accounting requirements will depend partly on the business structure you choose.

Branding & Marketing

It’s all good and well to be up and running as a licensed electrical contracting business, but it’s no good if you have no work to do.

Whether or not you need to worry about branding and marketing as an electrician depends on what your plans are for the business.

If you intend to subcontract to your existing building industry contacts, then marketing is something that’s probably not on your radar.

In this case you probably won’t even worry about a logo or stationary.

If you intend to get out there and chase electrical work from domestic and commercial clients then you’ll definitely need to sort yourself out with some branding.

A good looking logo is a great idea, along with business cards and a decent website.

There are a few companies out there offering designs services tailored to trades businesses, along with options for outsourcing.

As with business structures, branding and marketing for an electrician could form an entire article or two on its own.

A couple of articles with reading include Online Marketing for Tradies and Are Trade Directories Worthwhile.

More advice

If you require more information about starting your own business as an electrician there are three main points of contact.

For anything to do with your business structure, speak with an accountant. For anything to do with licensing, contact your state government, and for anything to do with insurance contact Trade Risk.

We can’t point you in any specific direction when it comes to marketing, but if you Google “tradie marketing” you’ll see there are a few firms offering various marketing services specifically for tradies.

Best of luck with getting your electrical business up and running!

Author: Shane Moore. Last updated: 5/08/2024