Handymen face many of the same risks as other tradies, and that makes handyman insurance a vital part of your business.

At Trade Risk we insure hundreds of handymen from all over the country, and we’ve put together the ultimate guide on handyman insurance!

If you’re after a quote please hit the orange button below, or to check out the guide simply keep scrolling.

To speak with one of our experts please call us on 1800 808 800 and we’ll be happy to answer your questions.

Thousands of self-employed handymen (and handywomen!) provide valuable services to householders and small businesses around Australia, and it’s our mission to make sure they are properly protected if things go wrong.

The ultimate handyman insurance guide

Having assisted hundreds of handymen and property maintenance professionals over the years, we have a very good understanding of what you need.

Below we have put together what we believe is the most comprehensive guide anywhere.

Jump to any of the following sections by clicking the link:

Types of handyman insurance:

Other information:

Handymen Love Trade Risk!

It’s all good and well for us to tell you how well we look after handymen and other tradies, but what do they really think about us?

We’re pretty sure they love us! We use an independent ratings agency, Feefo, to survey all of our new and existing clients.

The results are amazing, with a huge 98% of all clients rating us five stars!

As a result of these ratings and reviews, in 2017 (and again in 2018 and 2019!) Feefo awarded us the coveted Gold Trusted Service Award.

We’ve received quite a few awards over the years, but to receive one based on feedback from clients is a real thrill.

You can browse through hundreds of Trade Risk insurance reviews by following the link.

Types of Handyman Insurance

There are plenty of different types of cover which come under the handyman insurance banner.

The one you’re most likely to have heard of is public liability insurance, and tool insurance is also very important given the collection of tools you’re likely to have.

Let’s take a look at each of them in greater detail…

Public Liability Insurance

For any self-employed handyman, public liability insurance should be considered a must.

This policy will respond in the event that your negligence results in property damage or personal injury to another person.

A small claim under public liability would generally involve property damage. For example you might be carrying some materials through a client’s house and knock over an expensive vase.

This would generally be covered as you have damaged your client’s property.

At the higher end of the scale we have claims involving personal injury to a third party.

Such a claim could involve leaving a power cord across a hallway in a home or business, which someone trips over and suffers an injury.

If you are found to have been negligent in leaving the power cord in such a manner, your policy would respond.

Due to these risks, you will find that most real estate agencies and property managers will require that you have public liability insurance before you can do any work for them.

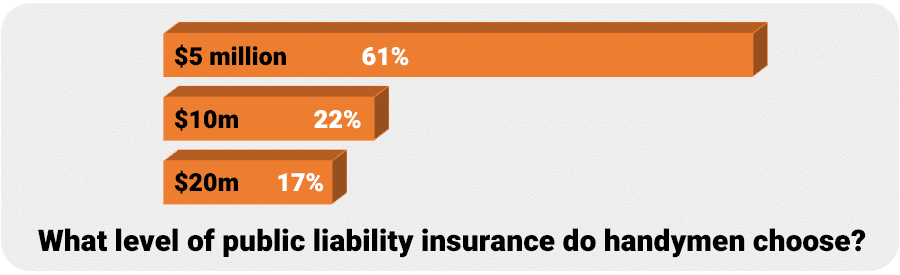

How much public liability insurance you need will depend on the types of work you are doing.

Most handymen opt for the minimum $5 million cover, but if you’re doing work for real estate agencies or property managers they may require a higher level of cover.

Our data shows that whilst most handyman businesses go for the minimum, almost 40% are selecting a higher amount.

The cost of going from the minimum up to $10m or $20m is quite low for a handyman or property maintenance business, so it’s certainly worth considering those higher levels for extra protection.

Tool Insurance

As a handyman you can undertake all sorts of work, and therefore you’ll generally need a decent collection of tools and equipment.

Unfortunately tool theft is rampant in Australia right now, and here at Trade Risk we receive multiple claims every week for stolen tools.

Whilst there is plenty you can do to help protect your tools, the reality is that these thieves will often get your tools if they want them.

Tool insurance is very affordable for handymen, with $5,000 worth of cover costing just a few hundred dollars per year.

A standard tool insurance policy will only cover your tools if forced or violent entry is required to access them, so even with insurance, you still need to protect your tools.

Cover is available that does not require forced entry, however it is considerably more expensive due to the higher risk.

Commercial Vehicle Insurance

Whilst thousands of handymen choose brokers like Trade Risk to look after their public liability and tools, vehicles can be a different story.

Many handymen (and tradies in general) insure their work vehicles with one of the big general insurance providers.

This is all good and well, but if you’re going to insure your work vehicle over the phone or online with one of the big guys, you need to make sure it’s properly covered.

First up, have you told them that the vehicle is being used for business purposes? This is an easy trap, and if you haven’t told them, they could potentially deny a claim.

If you have a custom tray or toolboxes in your ute, or custom shelving in your van, you need to check how these are covered.

A standard vehicle insurance policy will generally have very limited cover for this type of thing.

Vehicle signage and wraps are another important concern. Whilst a decent wrap might cost you around $4k, a basic vehicle insurance policy might not cover it at all.

This is where taking out a proper commercial motor policy with Trade Risk can make a huge difference.

Our policies are designed for commercial vehicles, so we can make sure you’re property covered for business use, and ensure that your modifications and signage are all fully covered.

You’ll still need to specifically tell us about all of these things, but at least we can then get you the right cover.

Business Pack

The dream for many small business owners, be they handymen or other tradies, is to make the jump from sole trader to a fully-fledged business.

This could involve having staff, multiple vehicles and your own premises with equipment and stock.

It’s a big change from running your business on your own from your ute and spare bedroom, and there’s a big change in your insurance too.

At Trade Risk our “bread and butter” is sole traders and one-man operations, but we also assist much larger businesses with more complex needs.

If your property maintenance business is growing we can help out with a range of different policies under a business pack. These covers can include the following:

- Public liability

- Tool insurance

- Professional indemnity

- Contents and stock

- Commercial motor (including fleet)

- Transit

- Business interruption

- Contract works

- Machinery breakdown

Some of these covers may not be necessary for a typical property maintenance business, but it’s good to know we can assist with them if you need them.

Other Insurance Types

For self-employed handymen one of the most important insurance types is income protection.

We don’t look after income protection insurance directly, however do have a referral partner we work closely with who specialises in income protection and life insurance.

Types of Work Covered

As a handyman there are so many different types of work that you could be undertaking from day to day.

Most of it can be considered property maintenance, we there are plenty of things which fall under this banner.

If there is any work your undertake which you think might not be standard for a typical handyman, we strongly recommend that you speak to us about them.

We’ll be able to confirm if a standard policy will cover the work, or if we need to make any changes for you.

Broadly speaking, handyman insurance will cover you for non-structural works and works not requiring a licence or trade qualification, such as electrical and plumbing.

This is a very broad statement however, and again we very strongly recommend that you contact us if there are any business activities that you are unsure about.

Domestic or Commercial Work

Another consideration when it comes to the type of work being undertaking is whether it is domestic or commercial.

Some insurers only cover handymen for domestic work, whilst some will extend cover to light commercial work.

At Trade Risk, provided that you let us know, we can generally arrange cover regardless of whether your work is domestic or commercial.

There are some exceptions which include heavy industrial sites such as power stations, railways, mine sites etc.

If you are working in any locations other than domestic homes and light commercial premises we strongly recommend that you contact us.

Real Estate Requirements

A common source of work for handymen is via real estate agencies and property managers.

If undertaking work for these businesses you’ll almost always find that public liability insurance is a mandatory requirement.

They will require a certificate of currency prior to undertaking work on any of their properties.

Interestingly, we have found that many handymen working for agencies are asked for professional indemnity insurance as well.

Broadly speaking, handymen have no need for professional indemnity insurance.

The agencies only ask for it because they are using the same generic form for all of the service providers they deal with.

If an agent or property manager provides you with a form stating that professional indemnity is required, we recommend double checking with them.

We’ve written a detailed guide about this here.

Public liability is generally the only handyman insurance requirement when it comes to real estate agencies and property managers.

Handyman Insurance Cost

Whilst there are plenty of risks involved in running a handyman or property maintenance business, they are considered relatively low risk overall.

This means that insurance for a handyman is very affordable, and is amongst the cheapest occupations when it comes to public liability.

For a sole trader undertaking standard handyman work, a public liability policy with a limit of $5,000,000 will cost well under $1,000 per year.

Trade Risk also offers monthly repayment options to help spread out the cost and assist with cash flow.

If your business has more staff, requires a high amount of cover or undertakes more risky activities, then the price of the cover will rise accordingly.

We can provide instant quotes on public liability insurance for handymen. Just click here and follow the prompts.

Tool insurance is also relatively cheap for handymen. Cover for $5,000 worth of tools can also be had for well under $1,000 a year.

For other types of cover please get in touch with us for a quote.

Next Steps

If you’d like more information about handyman insurance, or you’d like to start the ball rolling with some quotes, we’re here to help.

You can call us on 1800 808 800 or submit an online enquiry.

Our team are experts when it comes to handyman insurance. Our insurance brokers can provide you with all the advice you need to ensure you’re properly covered.

PS. If you’re just starting your handyman business, follow the link to check out our comprehensive guide to help get you started!