As Australians become more time-poor and perhaps a little less handy, starting a handyman business continues to be a popular way of becoming your own boss.

It’s isn’t necessarily difficult to start a handyman business, but there is a process to go through if you want to get it right.

At Trade Risk we have dealt with over a thousand handymen and women over the years, and we’ve used our experience to put together this guide.

We’ll be covering the following topics related to handymen and property maintenance businesses:

- Licensing

- Business Structure

- Insurance

- Branding & Marketing

- Franchising

- Accounting & Bookkeeping

- Banking

Licensing

Typically a handyman will not require a license, but this can vary depending on a few factors such as the state you operate in, the type of work you’ll be doing and the value of the work.

The following information is based on handyman not undertaking work that would require a trade qualification (eg. electrical or plumbing) or work that would require an occupational licence.

Important: This information was current at May 2019. We strongly recommend you contact your state authority to confirm the current requirements before starting your business.

Qld

No licence required provided that the value of any one job is no more than $3,300.

More info: QBCC

NSW

No licence required provided that the work is not valued at any more that $5,000 inc. GST.

If you are undertaking work valued at more than $5,000 you can apply for a “Minor Maintenance and Cleaning” licence, however there are qualifications required to quality for this licence.

More info: Fair Trading NSW

VIC

Victoria is a little more generous than most other states, with the limit of each job being $10,000 before a license in required.

More info: Consumer Affairs Victoria

Tasmania

We couldn’t locate accurate information for Tasmania, so we recommend contacting the Consumer, Building and Occupational Services department directly.

More info: Consumer, Building and Occupational Services

South Australia

We couldn’t locate accurate information for South Australia, so we recommend contacting the State Government directly.

More info: SA Government

Western Australia

It appears that work with a value up to $20,000 can be undertaken in Western Australia without a licence, but it’s not entirely clear. We recommend contacting the State Government directly for confirmation.

More info: WA Government

Australian Capital Territory

It appears that a Class D builders licence may be required for basic non-structural work, however there is no mention of the dollar value of such work.

We recommend contacting the ACT Government directly.

More info: ACT Government

Northern Territory

We couldn’t locate accurate information for the Northern Territory, so we recommend contacting the NT Government directly.

More info: NT Government

Business Structure

There are a few different ways to structure your handyman business.

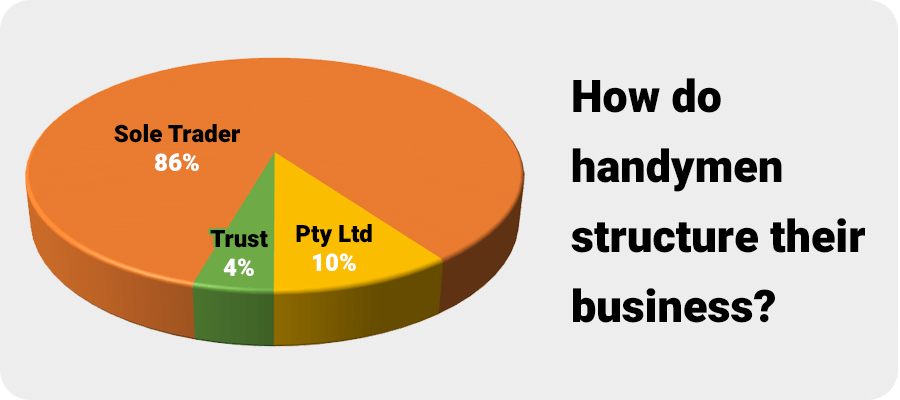

The most popular by far is to operate as a sole trader. This is the cheapest and easiest business structure to setup, and our data shows that 86% of handymen and property maintenance business go this way.

10% choose the Pty Ltd company option, and just 6% operate through a trust.

The 6% figure for trusts matches our overall data for trade businesses, however overall trades are twice as likely to go with the Pty Ltd option, with 22% of them going this way compared with just 10% of handyman clients.

What would be the reason for handymen being only half as likely as other trade businesses to go with a company structure? Most likely for the lower setup costs, as our earnings data shows that a handyman business will typically generate less revenue than a qualified trade business.

For more information refer to our handy sole trader or company guide.

Regardless of which business structure you choose when starting your handyman business, you’ll need to register for an ABN. An accountant can help you with this, or you can register one yourself for free.

If you’re expecting annual revenue of $75,000 or more, you’ll also need to register for GST. Again, an accountant could do this for you, but you can also do it yourself for free.

Insurance

Before you start any work it is vital that you have the right business in place. Failure to do so could leave you dangerously exposed financially.

The most important form of handyman insurance is public liability.

This is the insurance that will cover you in the event that you cause property damage or personal injury to another person.

You might think that the risks are fairly low as a handyman since your job value is typically on the lower side, but this has little impact on the level of insurance you require.

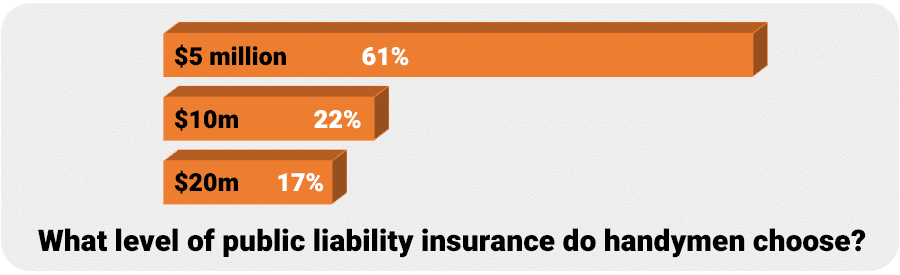

How much public liability insurance should a handyman have? There is no right or wrong answer here, but we can tell you how much cover other handymen insured with Trade Risk choose.

The majority do select the minimum $5 million coverage, but close to a quarter are opting for $10m and almost a fifth are taking the top option of $20m.

If you’re undertaking work for real estate agencies or property managers they may require more than the minimum $5 million.

Other forms of insurance which are important for a handyman include tool insurance and income protection. Here at Trade Risk we can put together quotes on each of these insurance types.

Branding & Marketing

This subject could easily form a huge article on its own.

Your branding and marketing is going to have a direct impact on how much work you’re bringing in, which will of course dictate how much money your handyman business makes.

On the branding side, the basics you’ll want are a decent logo and business cards. You should be able to have both a logo and business cards designed and printed for well under a thousand dollars.

Even if you plan on using word of mouth as your only marketing, the business cards are vital, and a decent logo on the card will go a long way in terms of a professional appearance.

With social media options such as Facebook and Instagram, some handymen choose to have these as their sole online presence rather than having their own website.

This is an option, but with a basic website costing little more than a thousand dollars, it’s definitely worth considering if you want to increase the professional appearance of your business.

There are plenty of options in terms of getting your name out there. Shopping centre notice boards are still popular after all these years, but online is where a lot of people do their searching.

Online trade directories and quoting websites are popular. A few of the big names are hipages, OneFlare and Airtasker.

There is some debate around in terms of how effective these are, especially in terms of cost, but they can be a great place to start given their large audience of potential clients.

Other options for advertising your handyman business include the good old Yellow Pages, or if you have your own website, Google Ads.

Franchising

If you’re not interested in doing your own branding and marketing and want to rely on an established brand, buying a franchise could be for you.

This could be an easier way of starting a handyman business, but keep in mind it will also likely be a more expensive way of doing it.

We have no experience in this area, but a few options to check are Hire a Hubby and Jim’s Building Maintenance.

Franchises can be tricky things, so make sure you do plenty of research before jumping in.

Accounting & Bookkeeping

You may not need to worry too much about accounting and bookkeeping at this early stage, especially if you’re going to operate as a sole trader, but it’s still worth knowing about.

Maintaining your books is a big part of running any business, and a handyman business is no different.

There’s no reason why you can’t do your own bookkeeping, but it is vital that you’re getting it right, and you might find that your time is better spent ‘on the tools’ rather than in the books.

There are plenty of bookkeepers around, and we’ve put together our own tradie bookkeeping guide that might help you when choosing one.

If you’re operating as a sole trader you can do your annual tax returns on your own, but if you’re setting up as a Pty Ltd company or a trust you’ll need an accountant to do them for you.

Banking

If you’re setting up as a Pty Ltd company you’ll need a separate bank account under your company name.

If you’re starting out as a sole trader you could keep using your personal bank account, but it’s far better to use a separate account to keep track of your business incomings and outgoings.

Either way, any bank will be able to set up a normal business account for you, but there are other options now for small business.

One newcomer worth checking out is Thrive. They’re launching an online-only bank account designed specifically for startups and small businesses.

More than just a bank account, it can help to automatically categorise your transactions and also allows you to scan and upload receipts to make tax-time a whole lot easier.

Disclosure: We don’t receive any kickbacks from Thrive, but we do have a relationship with them where they recommend Trade Risk to their clients.

More Advice

Starting any business is an exciting time, and starting your own handyman business could be the start of something great!

It’s important at this stage however to make sure you’re fully on top of everything before you go out chasing work.

The last thing you want is to do is start making some money, only to lose it all because you didn’t have the right insurance in place or made a mistake with your accounting or bookkeeping.

Best of luck with starting your handyman business, and if you’d like any help on the insurance side please get in touch with us.