We specialise in subcontractor insurance and have assisted over 10,000 tradies with their business insurance needs since 2010.

For an instant quote on public liability for subbies, please click here or call us on 1800 808 800.

We can also assist with personal accident insurance for self employed subcontractors and all other forms of business insurance. No matter how simple or complex your needs may be, our team of qualified insurance experts can work with you to put together the right package.

As Australia’s most awarded trade insurance specialist, you can rely on us for award-winning service and advice, not to mention super-sharp premiums to help save you money.

For more information or quotes please call our team on 1800 808 800, or continue reading our subcontractor insurance guide below which looks at the various forms of insurance for subbies.

Subcontractor Insurance Guide

There are two main forms of insurance which are important for subbies, and these are public liability and income protection.

There are other forms of business insurance which are also important, but these are the two that are especially important for subcontractors.

Both of these policies are designed to protect you financially against the risks that your employer would cover if you were still working on wages.

The three main risks covered by these two policies are as follows:

- Suffering a personal injury or illness yourself

- Causing personal injury to another person

- Causing damage to another person’s property

If you’re a subcontractor, you’re on your own when it comes to these risks.

The person or company hiring you is not responsible for any damage or loss that you cause, or for any injury that you sustain, so it is vital that you have your own adequate cover in place.

Let’s take a closer look at these two forms of subcontractor insurance, plus a few others that can offer great protection for subbies.

Public Liability

Public liability will generally be the first type of insurance required by a subcontractor. Not only is it a great cover to have, but most work sites will actually require that you have this cover.

Many companies that you are subcontracting for will also require that you show evidence of holding public liability insurance.

Some people ask us why they need public liability as a subbie, thinking that the company engaging their services should be responsible.

The reason you need your own cover is because things can get messy in the event of a claim.

If you were to cause damage or injury whilst on a job, the person suffering the loss (or more specifically, their lawyer) isn’t just going to sue one person. They’re going to drag everyone in.

The principle contractor, the head contractor, any subcontractors, everyone!

The court will then determine who was responsible, and how much money needs to change hands.

But here’s the thing – very rarely is a single person or company held 100% responsible in such cases.

Often they will find that one contractor was 40% liable because they did something, and the other contractor is 30% responsible because they didn’t do something else, and perhaps you as the subcontractor are also 30% responsible because of something you did or didn’t do.

So you might not be 100% responsible, but you are found to have been partly responsible.

The other contractor’s insurance companies will pay out their portions, but they won’t cover your portion. You’ll need your own insurance to cover this, otherwise you’ll be seriously out of pocket.

No matter what anyone else tells you, as a subbie it is vitally important that you have your own public liability insurance in place.

What does it cover?

Public liability insurance covers you in the event that you cause property damage or personal injury to another person as a result of negligence.

As a subcontractor you will be liable for any property damage or personal injury that you cause, so it’s vital that you have your own insurance policy in place.

How much do you need?

The minimum amount of public liability insurance for a subcontractor in Australia is $5 million.

How much you need to have depends on the contracts you are entering into, and whether or not they stipulate a minimum.

Some contracts may have a minimum requirement of $10m, some $20m and some no set minimum, in which case you’d be looking at $5m.

Broadly speaking, the higher the risk of a large claim, the higher the requirement will be. For example if you are subcontracting within a shopping centre, you’ll find that the minimum is most likely $20m.

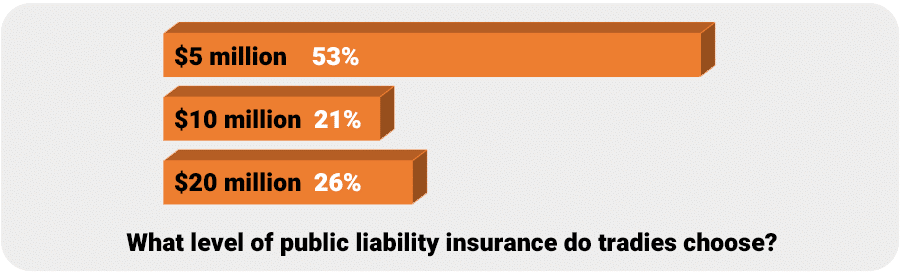

The following chart shows how what level of cover our clients typically take for public liability insurance. Whilst they’re not all subcontractors, many of them are.

This shows that the minimum $5m is the most common level of cover, but still close to half of all tradies are choosing a higher amount.

If you’re in doubt please ask the company you are subcontracting to if they have a set minimum.

You can learn more about public liability insurance here.

Income Protection

Some people call it accident and illness, and others mistakenly call it workers compensation, but a proper income protection policy is there to cover your own income if you cannot work due to injury or illness.

As a subbie you won’t have access to sick leave from an employer, and you generally won’t have access to workers compensation depending on your business structure and the state you are located in.

For this reason, many building companies actually require that subcontractors show evidence of their own income protection insurance before they’re allowed on site.

Regardless of whether or not you need income protection to get on site, it is still a vital form of subcontractor insurance.

What does is cover?

Income protection can replace a large portion of your income – typically 75% – for a period of time whilst you are unable to work due to injury or illness.

The length of time that your income will be replaced depends on what options you choose. The minimum benefit period is generally two years, whilst the maximum covers you through to age 65.

If it’s within your budget, it’s generally recommended that subcontractors and other self-employed tradies go with an age 65 benefit period for maximum protection.

We have more detailed information about income protection here.

Contract Works & Contractual Liability

These two forms of insurance are far less well known, particularly amongst smaller subcontractors, but they are definitely worth knowing about.

When we spoke about public liability earlier, we mentioned that a claim had to involve negligence on your part. i.e., you need to have done something wrong and have been at fault.

But what if you weren’t at fault? You might think this means you’re in the clear, but thanks to the contracts some companies use, it is not always the case.

When you sign a contract for a job you might find that the principal or head contractor has passed on some of their responsibilities to you.

This is not as uncommon as you might think.

So there could be a major issue on a job involving property damage or personal injury, and whilst you might not have been at fault at all, the contract you signed means you are responsible for it regardless.

Your public liability insurance won’t cover you, because you weren’t at fault.

This is where contractual liability insurance can save you. It covers claims where you weren’t at fault, but are still responsible due to the wording of the contract you entered into.

Contract works is a little similar, but it has less to do with the contract wording and more to do with other incidents that might not involve your actual negligence.

We have more information on contract works insurance and contractual liability insurance on our website (follow the links) however it’s best to speak with one of our insurance brokers about these specialised forms of cover.

Self Employed Subcontractor Insurance

When you make the switch from being an employee to a subcontractor you can gain a lot in terms of control over your time and your income, but you also lose a lot in the way of protection.

No longer do you have a big company to protect you if things go wrong, and in most cases you won’t have any sick leave or other benefits.

It is vital that you make sure you subcontractor insurance is up to scratch, especially your public liability insurance and income protection insurance.

Other types of trade insurance that you may find beneficial are tool insurance and commercial vehicle insurance. At Trade Risk we can package up a range of business insurance policies to meet you needs.

What about your own Subcontractors?

What if you’re the one using subcontractors? How does this affect your business insurance?

The most important thing you need to do is let your insurance broker or insurance company know that you are using subcontractors. If you don’t, and there is a claim involving subbies that you’ve engaged, you could find yourself in trouble.

Whilst your public liability insurance won’t cover the subbies, it will cover your use of subbies, provided that you have let the insurer know about it.

You should always ensure that any subcontractor you hire has their own public liability insurance in place.

Why is this? In the event of a claim involving subcontractors that you have engaged, you will often find that more than one party is responsible. For example it might be found that you are 40% responsible and the subcontractor is 60% responsible.

Both of you need to have insurance in place, as each insurance company will only pay their share of the claim.

Subbies Love Trade Risk!

We assist thousands of subbies, and all who take out a new policy with us are surveyed on their experience.

Independent ratings firm, Feefo, gathers ratings and reviews from our clients, and their independence ensures the authenticity of the feedback we receive.

The feedback we received is overwhelmingly positive, and in 2017 (and again in 2018 and 2019!) this resulted in Trade Risk receiving a Gold Trusted Service Award!

Our fantastic feedback along with the recognition provided by the award helps to give you the reassurance that Trade Risk is the right team to look after your subcontractor insurance needs.

More recently we won the Best Customer Service category at the 2018 Insurance Business Awards. This is a massive achievement, and truly shows that no one looks after subcontractors insurance – indeed all business insurance – as well as us.

If you’d like to find out how we can help you, or if you’d simply like a quote, call us on 1800 808 800 or use our online quote system.

Author: Shane Moore. Last updated: 24/06/2019.

What to read next…

- How Much do Tradies Really Earn?

- Starting a Trades Business

- Starting an Electrical Business

- Starting a Carpentry Business

- Switching from Sole Trader to Company