The public liability insurance cost for a trade business can be affected by a range of different factors.

A public liability policy could cost from as little as $500 for a sole trader needing the minimum cover, through to $100,000+ for a much larger or higher-risk trade businesses.

Click the button below for a quote, or keep scrolling to read our public liability cost guide.

If you’re not ready for a quote just yet, and instead want to find out more about what affects the cost of public liability insurance, we’ve put together a comprehensive guide.

We’ll be answering some of the most common questions asked by tradies and other business owners:

- How is the public liability insurance cost calculated?

- How much does public liability insurance cost?

- What factors affect the cost of public liability?

- Does using a broker cost you more?

- Find out the cost of your public liability insurance

How is the public liability insurance cost calculated?

The insurance companies each have their own ways of calculating premiums for public liability insurance, but the bulk of the cost is based on four main factors:

- What your business does

- Size of the business

- Where your business operates

- How much cover you require

We’ll now look at each of those points in a little more detail:

1. What your business does:

This is the main activity of your business, i.e. carpentry, electrical etc.

2. Size of the business:

The size of the business measured by either revenue or staff numbers.

3. Where your business operates:

If your business operates in any locations considered to be high risk.

4. How much cover you require:

From $5 million up to $20 million, with more cover costing more money.

The four factors listed above will give you a basic cost of your public liability insurance, however there are additional factors that can have an impact.

These certainly won’t be relevant for all business types, but they are worth keeping in mind:

- Your previous claims history.

- The state you are based in (affects the stamp duty component).

- Your usage of subcontractors or labour hire.

- Any work you undertake without may be considered outside of the norm for your industry.

We’ll now dig a little deeper into these factors.

How Much Does Public Liability Insurance Cost?

Public liability is one of the most important forms of insurance for a trades business, and provides a great level of financial protection from a range of incidents which can occur on the work site.

It’s impossible to give a blanket answer on how much public liability will cost, as the price can vary hugely based on the factors we outlined earlier in this guide.

We can give you a basic guide, but keep in mind that it’s merely a starting point and assumes there is nothing out of the ordinary about the business.

Below we’ve taken a random selection of real quotes sent to clients during the month of June 2023.

Although we quote plenty of businesses with multiple staff, for an easier comparison we’ve kept this list to businesses with only one staff member, who is generally the owner.

Public Liability Insurance Cost for a Trades Business

| Occupation | Revenue | Cover | Premium |

| Handyman | $40k | $5 million | $465 |

| Carpenter | $70k | $5 million | $545 |

| Carpenter | $80k | $10 million | $568 |

| Electrician (QLD) | $25k | $5 million | $583 |

| Carpenter | $150k | $20 million | $653 |

| Electrician (QLD) | $100k | $5 million | $682 |

| Plumber | $100k | $10 million | $960 |

| Plumber (VIC) | $500k | $5 million | $1,284 |

| Plumber (VIC) | $100k | $20 million | $2,112 |

* We have highlighted the electricians based in QLD and the plumbers based in VIC, as they have unique insurance requirements that result in slightly higher premiums.

As you can see, the cost of the insurance will bounce around depending on the occupation, the business revenue and the level of cover required.

So how much is your public liability insurance going to cost? In this guide we will take a look at how liability premiums are calculated and why you pay the amount that you do.

Factors Affecting the Public Liability Cost

The cost of tradies public liability insurance is influenced by a range of factors including the type and size of business that you operate, along with the amount of cover that you require.

As with most forms of insurance, the cost of your cover will ultimately be based on the level of risk that the insurance company believes you may pose.

Business Type

The type of trade business that you operate will have a major impact in your public liability cost.

Trades regarded as lower risk will pay lower premiums. This includes trades such carpenters working on residential and light commercial projects.

Other trades can attract much higher costs based on the potential risks. Some of the costlier trades include boilermakers and scaffolders.

Some trades can see increases in their premiums based on recent claims events. A current example is plumbers, who are seeing large cost rises across the board due to an increase in water damage claims.

Each insurer has different pricing for the different trades. For example one insurer may be the cheapest for electricians, but they may be the most expensive for carpenters.

Business Size

The size of your business will also have a major impact on the cost of public liability insurance for a tradesman.

Some insurers measure the size of a business by its turnover, some base it on staff numbers, and others base it on a combination of the two.

The public liability insurance cost is affected by the size of the business due to the potential for increased risk with a larger business. A higher turnover or higher staff numbers will generally equate to a higher insurance cost.

Part-Time Business

Some clients believe they should pay a lesser amount if they run their business on a part-time basis.

Generally this is not the case, and it’s due to something known as ‘minimum premium‘.

For example if an insurer bases their price on the number of workers, and your business has only one worker, the cost of the insurance is already at ‘minimum premium’.

So whether you’re working in your business full-time or part-time, the insurer is simply rating your policy at the minimum cost for one worker.

A similar situation applies for the insurers who set the insurance cost based on revenue.

Minimum premium will generally kick in at around $100k annual revenue. So whether your revenue is $100k or $50k, you’re already at the minimum premium and the cost will not get any lower.

Business Location

Your business location will affect your public liability cost in a number of different ways. You state will impact it from a stamp duty perspective, your geographical location may impact it from a risk perspective, and the types of sites you work on can affect it, also from a risk perspective.

State – Stamp Duty

Each Australian state charges varying levels of stamp duty on insurance premiums. This will affect your public liability cost differently depending on which state you are based in.

In NSW there is a further stamp duty saving if your turnover is below $2m. In this case your stamp duty cost will be reduced to zero on public liability and selected other forms of business insurance. This has the effect of reducing your overall public liability cost with a decent saving. Click here for more information on this exemption.

Geographical Location

Some insurance companies charge different premiums based on the geographic area that you work in. This works in much the same way that car insurance and home insurance will be priced differently depending on where you live.

For the insurers who do adjust their premiums on this basis, generally you will pay less if you live in an area with a good claims history, and more if you live in an area with a poor claims history.

Specific Worksites

Most public liability policies will exclude tradesmen who work on specific sites. Common sites which are excluded include airports, railway stations, power plants, mines and marine ports.

Working on these sites doesn’t necessarily mean you cannot get cover. It just means that you must go through a specialist insurance company, which will generally have higher costs than a mainstream insurance company.

Policy Size

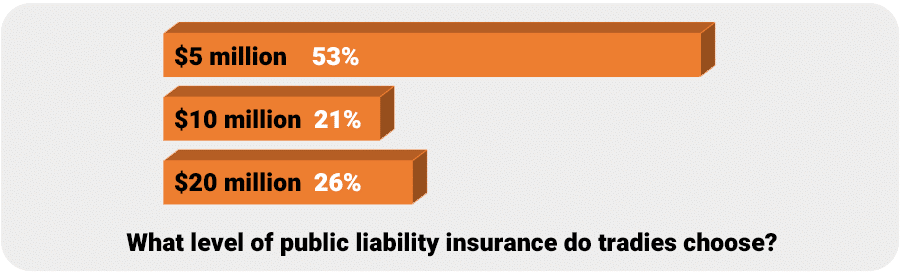

Public liability insurance comes in various levels, ranging from $5 million to $20 million for standard policies.

$5 million is the most popular level of cover for tradies, which probably has a lot to do with it being the lowest – and therefore cheapest – level.

The amount of cover you require will have an impact on the public liability cost for a tradesman, but thankfully the increase isn’t too great, and double the cover will cost you less than double the premium.

Subcontractor Use

If your business engages subcontractors you may find that your public liability insurance cost increases.

Depending on the insurer, a low level of revenue paid to subcontractors may not impact the cost at all, but if you’re paying 20% or more to subbies there will be an impact.

Again it will depend on the insurer, but broadly speaking the greater the level of revenue paid to subcontractors, the greater the impact to the cost of your cover.

Other Factors

There are various other factors which can come into account when calculating the cost of public liability insurance.

Generally this only affects trades businesses that operate outside of the normal activities for a tradesman. A huge number of trades are covered under standard policies, but if you do something outside of the norm you may face different costs for your insurance.

Does using an Insurance Broker Affect the Cost?

This is a classic question considered by many when considering any form of business insurance.

It’s natural to think that if you’re using someone like a broker that the insurance cost it going to be higher. After all, the broker must be making some money from somewhere right?

The truth is actually just the oposite, and a good insurance broker can actually reduce your public liability insurance cost.

How so? Well for starters they will know the market better than anyone, and know exactly which insurers to approach when shopping around. You might get quotes from a couple of websites, but a broker can access quotes from dozens of different insurers.

Some brokers can also rely on their buying power to secure lower prices. On your own you’re just a single buyer, but you broker could be buying thousands of policies a year from that insurer, and may have negotiated better premiums.

There are also specialist insurance and underwriting companies out there who only deal with brokers. So your broker may be able to secure you a great deal with a provider that otherwise wouldn’t deal with a private buyer for a single policy.

Aside from pure pricing, a broker can use their experience to get a better understanding of your business, and may find other ways that you could be saving on your insurance.

So don’t think for a moment that using an insurance broker (a good one at least) is going to cost you more. In our case, we often find that we can secure our Trade Risk clients lower rates than they’d ever be able to secure on their own by going direct.

Finding Out Your Public Liability Cost

The easiest way to find out your public liability cost is to speak with a suitable insurance broker who specialises in trade insurance services.

Here at Trade Risk we have a network of specialists who specialise in tradesman insurance and will be able to help you in determining your public liability insurance cost along with providing assistance in getting your business covered.