What makes one tradies public liability policy different to another?

We speak with a lot of trade business owners every week, and sometimes we’re asked why there is a difference in cost between two policies which seem the same.

The thinking is, if one public liability policy covers a carpenter for $5 million, it’s no different to another policy which covers the same trade for the same amount.

And with that being the case, why would one policy be more expensive than the other? Presumably the more expensive one is just a rip-off, right?

Wrong!

Two policies which seem the same on the surface can actually be massively different, and can have huge consequences at claim time.

Let’s take a look at some of the differences…

Excess

This is a fairly basic difference that most people will understand. Just like your home or car insurance has an excess, so does public liability insurance.

Some policies have an excess as low as $250 per claim, whilst others can be $2,500 or more.

The higher excess could be a result of your higher-risk trade, your claims history or perhaps an insurer which just has a higher excess for their own reasons.

Either way, the difference at claim time is important. You might choose a policy which is $50 a year cheaper but has a $500 excess. If you don’t make a claim, you’ve done well. But if you do make a claim, you would have been better off with the slightly more expensive policy that had a lower excess.

When comparing the premiums on two different public liability insurance policies, make sure you look at the excess and not just the initial cost.

Domestic V Commercial Work

All policies don’t necessarily cover all types of work.

Taking an electrician as an example, some insurer’s standard public liability policies only cover domestic, some cover domestic and light commercial, whilst others cover anything other than industrial.

But that might not be completely obvious when looking at the quote. Instead you need to dig into the Product Disclosure Statement (PDS), policy wording or policy schedule.

As an electrician you might get one public liability quote for $500 and another for $700. You might think the $700 policy is too expensive, without realising that the cheaper one won’t actually cover the industrial work you’re doing.

If you then need to make a claim for the industrial work you were doing, you could find your claim declined and yourself out of pocket by thousands of dollars (or much more) just because you tried to save a couple of hundred on the premium.

Make sure you check that all of your work activities are included. A good trade insurance specialist broker (such as Trade Risk) can help you through this process.

Exclusions

Whilst there are some fairly standard exclusions across the public liability insurance policies offered by different companies, there are some unique differences too.

Most standard policies will exclude work on airports and oil rigs for example. If you’re comparing a couple of common policies, you won’t notice much difference in that area.

But there can be other differences in exclusions between policies, and sometimes in areas that you wouldn’t expect.

For example one well-known insurer recently limited cover for plumbers working on buildings greater than three storeys.

If you have a policy with that particular insurer, the difference between a three-storey building and a four-storey building could be a declined claim leaving you in major financial trouble.

So before you decide one policy is more expensive than the other and therefore a rip-off, check the exclusions to see if there is a good reason for the difference in price.

Customer Service

It’s one thing for the policy to be up to scratch, but what about the service behind the product?

This is another area where you need to consider the differences between what’s on offer.

One policy for example could be offered by an online-only provider who doesn’t offer phone support. Their public liability quote might be super cheap, but so is their service.

Or perhaps they do offer phone support, but you’re dealing with a call centre filled with staff who only meet the minimum training and experience requirements, and may only deal with a tradie once or twice a week.

Compare that to Trade Risk, where every client has their own account manager who is a qualified and experienced insurance broker. You have their direct mobile number to call them anytime, and you know that you’re dealing with someone who specialises in the trades.

That might not mean much when purchasing the policy, but it could mean an awful lot when things go pear-shaped and you need an expert on your side to guide you through the claim process.

The cost of an insurance policy is generally going to take into account the cost of the people standing behind it. If you want the best service, you’re probably not going to get it from the cheapest policy.

Putting it into context

We completely understand that business insurance can become quite complex, which is why we recommend using a specialist trade insurance broker such as us.

But to put the above into context, here’s an example to think about.

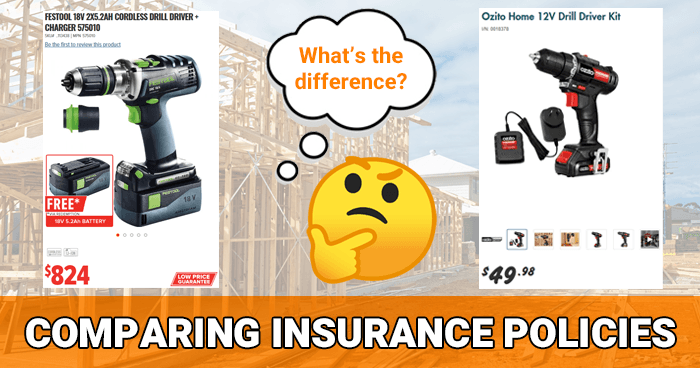

Let’s say we’re comparing two cordless drills. I found this Ozito drill at Bunnings for $49, and this Festool drill at Total Tools for $824.

One is almost 20 times more expensive than the other! But they’re both just cordless drills right? You stick a drill bit in the end and makes holes in things…

As a tradie, you’d laugh at us for even mentioning those two items in the same paragraph! But the same is true of public liability, and any other form of insurance for that matter.

You might think that two policies are both the same, but to us we might immediately know they are completely different and not comparable at all.

Just like the Festool drill isn’t a rip-off just because it’s more expensive than the Ozito, one public liability policy isn’t a rip-off just because it’s more expensive than another.

Getting advice

Ultimately it pays to get the right advice. If you can’t tell the difference between two policies, or more likely don’t have the time to conduct a thorough comparison yourself, trust a professional to do it for you.

You’re the expert at your trade and know which tools you need, whilst we’re the experts in trade insurance and know which policies you need.

If you’d like to speak with a trade insurance specialist about you needs, click here to contact us online or call our friendly team on 1800 808 800.