Running a trades business is full of risks. Some risks you can manage on your own, and some you can’t.

For those you can’t manage on your own, you manage them via business insurance.

But if you don’t have an unlimited budget to spend on insurance (no one does!) what are they key forms of insurance that will provide the best bang-for-buck?

In this guide we’ll take a look at the tradies insurance types that provide the most value for self-employed tradies.

Our top three:

Public Liability Insurance

Imagine being able to cover a five-million-dollar risk for around five hundred bucks?

That’s the reality with public liability insurance!

Any self-employed tradie would be mad to operate without public liability insurance at almost any cost, but in fact it is one of the cheapest business insurance types you’ll find.

Public liability insurance covers a tradie where your business activities result in property damage or personal injury (including death) to another person.

Most claims that tradies make on public liability insurance are relatively small, ranging from a few grand up to maybe $50k or $100k for something more serious.

So you might be thinking, why do we have to insure for a minimum of $5 million?

Whilst claims of this size certainly aren’t common, they have happened in the construction space.

Usually such claims involve death or permanent disability that your work has caused.

Most tradies will thankfully go through their careers without ever being involved in such an event, but they can and do happen.

You could probably cover a claim for a couple of grand out of your back pocket, or extend the mortgage for a $100k claim, but what if you were hit with a million-dollar claim?

That’s the sort of claim that could cost you your house, your business, and sadly more in some cases.

For $500* a year, you’d be mad not to have public liability insurance. It is without a doubt the best bang-for-buck insurance for a tradie.

*$500 is just a round number we’ve used. Policies for standard trades with a single worker, with no hazardous works or working locations can be had for this amount. Larger businesses, or those with other risk factors will be higher.

Tool Insurance

This is one that is bound to result in debate!

When tool insurance is raised in discussion on the various tradie Facebook groups, you’ll find plenty of people saying it’s not worth it.

They’ll tell you that you’re better off putting the money aside and using it to replace the tools if the worst does happen.

That’s fair enough, but it all depends on if or when your tools get knocked off.

Their argument is, that if it costs $400 a year for $5k worth of tool insurance, you could just put that money aside and you’d have enough to replace the tools every twelve years.

Sure. If your tools never get stolen, or are only stolen once every twelve years, that works perfectly fine.

But what if your tools are stolen in year one? You’ve paid $400 and saved yourself $5,000. That is pretty good bang-for-buck!

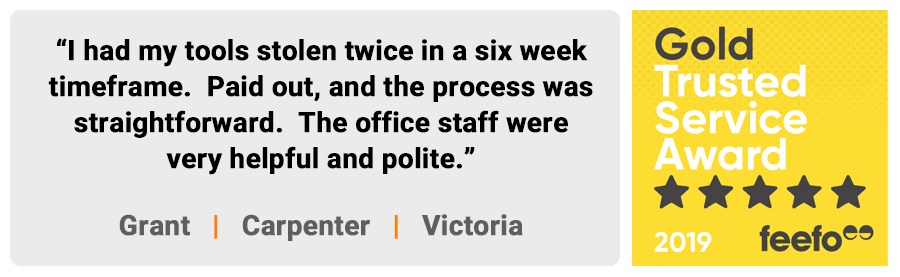

We’ve had clients at Trade Risk who have had their utes or trailers cleaned out more than once within a couple of years. In their case, having tool insurance has saved them many thousands of dollars.

Maybe those guys will keep paying tool insurance every year for the next twenty years and never suffer another theft. Or maybe they’ll get cleaned out another one or two times… Who knows? That’s why smart operators insure their gear.

Personal Accident Insurance

We’re going to cap this list at three different types of tradies insurance, and number three on the list is personal accident insurance.

You might be more familiar with the term income protection. This is a very similar form of insurance, but is available via financial planners rather than insurance brokers like Trade Risk.

The cost of personal accident insurance will vary greatly depending on a host of different factors including your age, your occupation and the various options you choose for the policy.

But let’s say you’re a relatively young and healthy electrician, and you’re paying $2,000 a year for a policy which covers you for $1,000 a week.

You might tell yourself that you never get sick and you’d never hurt yourself badly enough to be off work for more than a couple of weeks.

Most of us could get through a few weeks without an income, so why bother with insurance?

But what if you smashed up your leg and couldn’t work for a couple of months? What if you suffered a serious injury and couldn’t work for a year or more?

With personal accident insurance being able to pay out over multiple years whilst you’re unable to work, that $2,000 premium could turn into a payout worth $100k+ whilst you recover.

That income might be the difference between being able to pay the mortgage and feed the family, or having to rely on Centrelink benefits and sell the house…

Pack ‘em up!

Packaged up with Trade Risk those policies might only cost you a couple of grand per year, but could provide an enormous amount more in benefits if and when something went wrong.

We totally get it though… You could spend $3k on business insurance that you might never claim on, or you could spend it on a nice little weekend away with the family.

The second option sure seems a lot more appealing, but in business you have to think long term.

Think about what you’re trying to build with your business. If you’re trying to build something of value, trying to grow your wealth and ultimately your lifestyle with your family, you need to protect it.

What’s the point of working so hard if a single incident could send you back to starting from scratch?

We’re not telling you to buy every single insurance policy under the sun though…

Spend your insurance budget wisely and insure against the things that have the biggest potential to hurt you financially. Our experienced brokers can help you with this.

We’ll help you to get the best bang-for-buck on the insurance types that really matter to you.