Most tradies are well aware of how bad tool theft is in Australia, and how damaging it can be for any trade business.

But based on our data from thousands of tradies, most don’t have tool insurance.

Why?

The cost shouldn’t be much of a barrier, as a basic policy can be had from around $30 a month. Considering how it can protect thousands of dollars’ worth of gear, it’s a pretty good deal.

Another element is the “it won’t happen to me” attitude. But given that it does happen, a lot, there is a fair chance that it could happen to you.

One of the reasons that we do see from time to time, especially on social media, is that tool insurance never actually pays out. That there is always some loophole for the insurers to use.

We can’t speak for other insurers or brokers, but when it comes to our clients, we can kill this theory very easily!

So in this guide we’re going to look at some of the issues that may have caused the misconception that tool insurance doesn’t pay out, and we’ll show how it absolutely does pay out.

Our data proves it does pay

First up let’s look at some stats.

We’ve looked at the last five years worth of our own tool claims and found that we’ve helped our tradie clients claim hundreds of thousands of dollars on their tool insurance policies.

Those hundreds of thousands of dollars certainly didn’t come out of our pocket though! It was paid from the insurers we use, and trust that they’ll do the right thing at claim time.

We also found that the average claim size is $4,130. It’s not an amount that will send the average trade business owner broke, but it’s enough to ruin your week.

Whilst the average claim size was under $5k, we had plenty of claims around the $15k mark, which is going to wipe out a month or more of profit for a typical trade business owner.

Claim sizes have also increased fairly steadily over the last five years, so it’s getting more and more expensive every time your tools are knocked off.

Year Average Claim Size

2015 $3,578

2016 $4,087

2017 $3,813

2018 $4,076

2019 $4,410

Something else interesting for the “it will never happen to me” crowd is the number of clients who’ve suffered multiple claims on their tools.

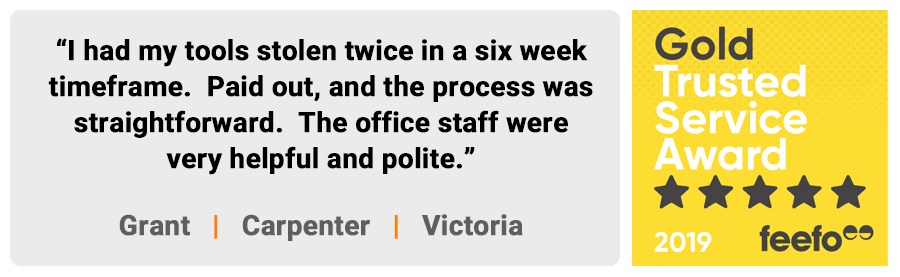

Over 10% of our clients who claimed on their tool insurance have claimed twice, and a small handful more than twice!

You might think it can never happen to you, but our data shows that it has happened to plenty of tradies two or even three times within a five year period.

Why do tradies think it doesn’t pay?

Now that we know tool insurance can and does pay claims, why is it that some tradies think it doesn’t pay?

Some of it is probably the healthy scepticism that some people have for insurance companies.

But for every one declined claim that makes it onto the news, there are thousands of claims that are successfully paid without any fuss every day across Australia.

So what causes a tool insurance claim to be declined?

Not having the right cover

Most of the time it is a misunderstanding of what is covered.

Recently there was a discussion in the Tradie Boss Facebook group and one member commented that tool insurance was a waste of time, as it doesn’t pay out.

Upon further investigation, it turned out the tradie was trying to claim on his home contents insurance, but as with most contents insurance policies, whilst they do cover personal use tools, they won’t cover tools of trade used in your business.

It’s a shame that the guy’s tools were stolen and not covered by insurance, but at the end of the day, he simply didn’t have a tool insurance policy.

That’s why one of the catchphrases we use at Trade Risk is “If you take your business seriously, you should take your business insurance seriously.”

If you run a business, you need proper business insurance. Don’t just hope that your personal insurance is going to cover you.

Not knowing how your tools are covered

Even if you take the step of properly insuring your tools, it’s still vital that you know how your tools are covered.

Whilst your tools are covered for theft, not all policies will cover all types of theft.

Most policies will only cover your tools for theft provided that forced or violent entry was required to access the tools.

This can include a wide range of claim types. Looking through our own claims data, some of the common forms of forced entry included the following:

- Toolbox padlocks cut

- Toolbox lid forced open

- Broken locks on garage door

- Vehicle windows smashed

- Shipping container broken into

- Trailer broken into with a grinder

- Ute canopy smashed

- Vehicle containing tools stolen

- Trailer containing tools stolen

- Vehicle keys stolen after breaking into house

- Trailer chain cut

- Site office broken into

- Vehicle locks drilled out

As you can see, there are plenty of different ways that your tools can be stolen that involve forced entry, which meets the requirements of most tool insurance policies.

What is not covered by most policies however is the theft of tools where there is no evidence of forced entry.

For example if you keep your power tools unsecured in the back of your ute, and someone steals them, they’re not going to be covered.

You might be pretty annoyed that you had tool insurance and weren’t covered, but any good broker would have explained the limitations of the cover.

You can choose to upgrade your cover so that they are covered in “open air”, however the price is higher and we find that most tradies don’t go with the more expensive option.

Another important point is when it comes to understanding the policy is knowing which items have to be specified on your policy.

For a typical tradie most of their tools can be covered under a blanket cover commonly referred to as ‘unspecified items’.

You’ll still need to list each item separately in the event of a claim, but when taking out the policy you can list them under the unspecified amount.

For more expensive items however, many policies will require that the item is specified. The dollar figure is typically around $2,500. So for any item with a replacement value higher than that, you’d need to have the items specifically listed on your policy.

If you make a claim for an item valued at $5k, but haven’t listed it on your policy, you will likely find that the insurer won’t pay the full claim amount for that item.

So understand your policy, know which items have to be specified, and ensure you keep the list updated whenever you add new tools or equipment to your business.

Not being able to prove ownership

If you do have tool insurance, and you have suffered a loss that is covered by the policy, there is one last hurdle to jump.

You need to be able to show the insurance company that you did actually own the tools you are claiming.

In theory this is very easy. You should be keeping all of your invoices and receipts for tax purposes, and this is all the insurance company needs to prove ownership.

But sometimes you don’t have this. You might have bought the tools second hand, you might have been gifted them, or you might just be really bad with your paperwork!

The insurers aren’t going to use this as a get-out card though. They’ll work with you. If you still have the original cases or user manuals, this may be enough to establish a link to the stolen items.

If you’re unable or unwilling to provide evidence however, the insurer isn’t going to pay you thousands of dollars for nothing.

How to ensure you will be able to claim

If we’ve convinced you that tool insurance is worth considering, here’s what you need to do to ensure things go smoothly at claim time:

- Understand what your policy actually covers

- Don’t assume anything – ask your broker!

- Keep detailed records of all your tools and equipment

- If you suffer a loss, report it to the police as soon as possible

- Provide as much information as possible when lodging your claim

It’s as simple as that really. We have some tool insurance claims that are paid to the tradie within days, and others that can take weeks.

The difference is all in the information provided. If the tradie can give us the police report details, a breakdown of all items being stolen and evidence of ownership, and quotes for the replacement items, the claim can progress extremely quickly.

But if you send through vague details, such as writing “assorted tools” on your claim form and not providing evidence or replacement quotes, your claim could take a lot longer as we keep having to go back and forward chasing information.

It’s also important not to fight the process. As your broker, the claim money doesn’t come out of our pocket, so we have absolutely no motivation to hurt your claim. We just want to get you paid as quickly as possible!

We do get the occasional client who will argue that they shouldn’t have to provide so much information, or that the process is too hard, but all they’re doing is wasting time and energy.

The insurer isn’t going to change their process. Just play by the rules and let us take care of it. If we think the insurer is being unfair in any way, we’ll fight them on it.

Remember that we’re on your side. You are our client and we want the best outcome for you.

We’ve put together a detailed article on preparing for a stolen tools claim that you might find useful. Follow the link to check it out.

Tool insurance – it does pay

To wrap things up, the facts are clear that tool insurance absolutely does pay claims.

But you need to do your part as well. Make sure you have the right cover (your broker can help you here) and make sure you’re prepared for a claim and follow the right process.

If you have any questions about tool insurance please contact us for a chat and we’ll be happy to put some quotes together for you.

Keep in mind that we only look after tool insurance when you have other forms of business insurance with us, such as public liability insurance.

The reason for this is that as a broker we make very little money from a tool insurance policy, yet they require a lot of work when it comes to claims.

If you have the rest of your business insurance with Trade Risk we’d absolutely love to help with your tool insurance, but if you only need tool insurance, you’d be better of going direct to an insurer.

This is common amongst most insurance brokerages, not just Trade Risk. But if you’re a serious business, you should be insuring a lot more than just your tools anyway!

Get in touch with us and we’d love to help you out.

PS. Check out our guide on protecting your tools for more ways to keep your gear safe.